Do The Skin-Fasting, Skip-Care, #NoBuy, #ShopMyStash And Sustainability Movements Add Up To A Pullback In Skincare Spending?

Last week, Alison Wu, the health and self-care guru behind Wu Haus, embarked on a seven-day break from beauty products in response to a Man Repeller article on skin fasting, a practice promoted by the company Mirai Clinical. Her beauty abstinence (no cleanser, makeup, lipstick, serum or moisturizer!), while only lasting a short time, changed the personal care maintenance perspectives of many of her nearly 185,000 Instagram followers.

“I now simplified my skincare after the fast and the annoying dry spots are gone,” one fan told Wu, noting the dry spots on her face were solved better by avoiding moisturizer than applying it. Another fan remarked, “Watching you do it makes me think about all the products I slather on (sometimes) without intentionality. It’s definitely made me sit back and think about what my skin NEEDS and what I can stop spending money on.”

Skin fasting is among several movements, including the slimmed-down K-Beauty method skip-care, eco-consciousness, and social media-fueled purchasing reevaluation initiatives #NoBuy and #ShopMyStash, which has been championed by anonymous Instagram beauty collective Estée Laundry, calling upon consumers to put their skincare shopping under the microscope. Combined with a softening housing sector, trade policy uncertainty, and political upheaval at home and abroad, there’s intensifying apprehension in the beauty business that the movements could be a drag on the high-flying skincare category.

“There is rising speculation that there is going to be a recession,” says Lucie Greene, worldwide director of The Innovation Group at J. Walter Thompson. “And it’s gotten much more crowded and confusing in the skincare market as well. There is a refocus on the essentials and what really makes a difference.” She adds, “There’s a countermovement against peak K-Beauty where there were these highly elaborate routines. Then, of course, there’s the environmental issue with packaging and wanting things to be streamlined to reduce your footprint.”

Greene doesn’t go as far as predicting a major sales retreat in the skincare market, but underscores the factors yielding last year’s skincare frenzy could be challenged this year, and skincare brands should consider pivoting to respond to the new realities. They can emphasize their sustainability programs or minimalist formulas, for example, to remain relevant in a skincare landscape that’s shifting, albeit perhaps gradually, from its recent heyday.

In 2018, The NPD Group estimates prestige skincare sales in the United States jumped 13%, compared to 9% in 2017, and contributed 60% of the prestige beauty industry’s total gains. During the same period, makeup eked out a 1% sales hike versus 6% in 2017. Larissa Jensen, executive director and beauty industry analyst at The NPD Group, forecasts slower prestige beauty sales growth in 2019 as economic reservations dampen consumers’ appetite for discretionary expenditures.

“I’ve already stocked up on more than I can use, so it’s time for me to use it up before trying more.”

Samantha Goodnow, who chronicles her skincare outlays and accounting under the Instagram handle @skincareandsavings, racked up $1,000 in Sephora bills last year. She started this year with a goal to take control of her finances and rein in beauty buying. “I have heard rumblings that the economy is set for another recession, but, overall, I just need to save money for myself anyway, and beauty purchases were a huge, unnecessary purchase for me last year,” explains Goodnow. “Plus, I’ve already stocked up on more than I can use, so it’s time for me to use it up before trying more.”

Goodnow’s plan to reduce skincare spending suggests that skincare could follow makeup’s lead. Prior to its humdrum 2018, makeup was a blazing category in 2017, when its prestige sales climbed 12%, and it was responsible for 82% of the gains in the prestige beauty industry. Consumers were snapping up eyeshadow palettes with every influencer mention. Eventually, their makeup bags were stuffed, and it became harder to persuade them to shell out for cosmetics.

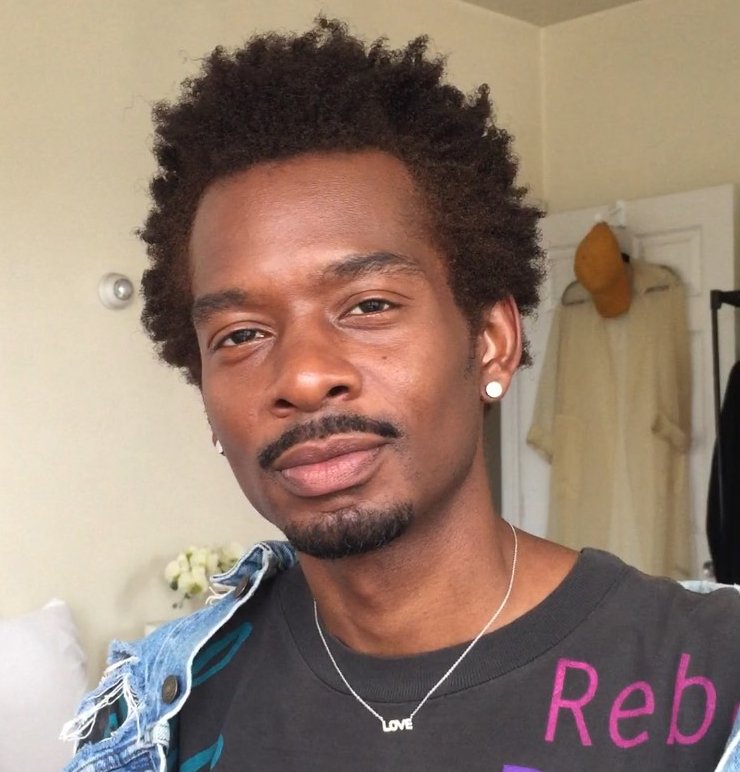

Saleam Tyree Singleton, a beauty Instagrammer known as The Method Male++, isn’t readily parting with his money to procure skincare products today. “I’m putting quality over quantity. I don’t need to see a cabinet full of brands. What makes a product worth it for me? Ingredients, actives, shelf life and, of course, results,” he says. “It’s not easy at all! But I plan to continue overthinking my purchases. Do I need it? Does it make my life easier? Can I afford it?”

Singleton’s extensive skincare deliberations show that skincare brands must make compelling arguments to win real estate in packed bathrooms. They can’t simply release a copycat mask or facial oil. Although she’s not convinced #NoBuy and #ShopMyStash campaigns are spreading from social media to the mainstream, K-beauty expert Jude Chao, the blogger behind Fifty Shades of Snail, says, “If retailers and brands do wish to mitigate the effects of frugality trends on social media, they should look to offer truly unique products with high utility and value. Marketing for existing products should focus on any multipurpose capabilities the products have and how they can save the customer money in the long run.”

“I’m putting quality over quantity. I don’t need to see a cabinet full of brands. What makes a product worth it for me? Ingredients, actives, shelf life and, of course, results.”

Clean beauty brands with multifunctional and minimalist positioning such as Ayuna, Five Dot Botanics and Bella Aura have messages that could resonate. “It can be easy to lose the joy in self-care when we feel overwhelmed by the amount of products on the market and the 10-step Korean beauty routine,” says Lin Chen, founder of Pink Moon Co., a beauty consultancy that counts Bella Aura as a client. “With the skincare space getting more and more crowded, consumers are getting more confused and stressed about their skincare routines. There is something beautiful about simplicity and how it can help us de-stress.”

Launching soon in the United Kingdom, Five Dot Botanics’ skincare products center around five ingredients. Co-founder Zaffrin O’Sullivan asserts the brand’s mission to deplete less of earth’s resources and not bombard consumers with convoluted ingredient decks is germane to leading beauty consumers. “People are becoming more and more interested in mindful consumption [and] paring down beauty is a natural next step,” she says, elaborating, “Underpinning all…is also that real wages are squeezed. So, buying less and consuming better really is of the moment as people can no longer sustain putting beauty on the credit card just to keep up with latest trends.”

To combat trend exhaustion, product efficacy and clinical testing are critical. Greene says, “There is a proliferation of activity and all these different product launches, and I think the next wave is the rise of more clinically-proven claims and an emphasis on the grown-up iteration of the products.” Gabriella Beckwith, beauty and fashion analyst at Euromonitor International, posits brands must deliver on beauty consumers’ demands that skincare products produce a healthy glow to satisfy them. She says, “As consumers become increasingly conscious about what products are right for them, they will have higher expectations for the results of each product being used.”

If there’s a trend suited to the current beauty climate, it’s J-Beauty. Sephora is bullish on J-Beauty’s momentum, and has spotlighted the brands Shiseido, SK-II and Tatcha to leverage the trend. Greene says, “The Japanese approach is very much about simplicity, ritual and good quality. When it comes to long-term skincare, that is always what people return to.” Last year, Tom Winarick, CEO and president of BioBoutique Beauty Lab, U.S. distributor of J-Beauty brand Adsorb, told Beauty Independent, “I believe personally that the long-term view of skincare is the future.”

“If retailers and brands do wish to mitigate the effects of frugality trends on social media, they should look to offer truly unique products with high utility and value.”

In the short term, skincare sales aren’t careening off a cliff—and some beauty prognosticators figure the market isn’t likely to budge much. “The extent to which purchase behavior may reduce is debatable, considering the dominance of fast beauty in the industry, particularly in the area of color cosmetics,” says Beckwith. “We are not only seeing brands launching more collections per year, but many are facing increased pressure to become more agile, and churn out new products in shorter turnaround times.”

Beth Zold, an English professor and K-Beauty convert, is in the Beckwith camp. She’s not abandoning her 20-step skincare routine. “I am going to keep doing my routine because it has really helped my skin,” says Zold. “Skip care does not fit me at all. It doesn’t fit my skin. I don’t feel the need to make my routine shorter because that’s the new fad.”

KEY TAKEAWAYS

- The skincare category was on a tear last year, but various trends are signaling a slowdown could be eminent. Macroeconomic circumstances such as the softening housing segment, and social media movements like #NoBuy and #ShopMyStash indicate a dialing back of discretionary spending on skincare.

- Beauty market shifts away from elaborate K-Beauty skincare routines and widespread skincare experimentation could also depress skincare spending. Makeup sales decreased after consumers stopped snapping up every cosmetic launch that hit beauty assortments, and skincare sales could follow suit.

- As beauty consumers become more discerning about their skincare spending, skincare brands with messages tied to minimalism and sustainability could be particularly resonate. In addition, J-Beauty brands selling time-tested skincare solutions and brands instituting rigorous clinical testing could cut through the clutter.

- Beauty industry experts don’t predict a dramatic skincare sales falloff. Instead, most envision growth slowing gradually as the conditions in the beauty market that pushed skincare to the fore persist.

Leave a Reply

You must be logged in to post a comment.