Unilever And TSG Consumer Man Up With Dr. Squatch, Dude Wipes Deals

The beauty and personal care mergers and acquisitions market got a double dose of testosterone Monday, when Unilever announced its acquisition of Dr. Squatch and TSG Consumer swiped a minority stake in Dude Wipes.

At a moment when entertaining content is practically a prerequisite for shelf placement and scroll stoppage, the brands have cultivated distinct voices appealing to male consumers who never fully jumped on board the unisex personal care train that took a hard U-turn from Axe’s 2000s-era highly sexualized vision of masculinity.

Dr. Squatch has made natural soap manly with advertising featuring Mike Tyson and James Schrader, and body wash racy with spots starring Sydney Sweeney, its so-called “Body Wash Genie.” The brand infused Sweeney’s bathwater in 5,000 limited-edition soaps that quickly sold out last month. Promising to deliver the “best clean, pants down,” poop jokester Dude Wipes, proudly the first butt wipes brand to say “butt” in its marketing, has partnered with Nascar and WWE on sponsorships.

“Men want wellness products, but the average joe still appreciates products made by and for men,” says Charlie Razook, founder of the men’s grooming brand Jackfir. “It’s a modern man that takes care of himself, but still wants to feel masculine, a fragile push-pull.”

Unilever cites Dr. Squatch’s “viral social-first marketing strategies, partnerships with influencers and celebrities, and culturally-relevant collaborations with limited-edition packs” as sales and loyalty drivers critical to its purchase of the brand from private equity firm Summit Partners. In March, Unilever CEO Fernando Fernandez disclosed that the company was increasing its media spend on social channels from 30% to 50% of its budget and would partner with 20X more influencers.

In a statement, Dan Costello, managing director of TSG Consumer, lauds Dude Wipes as a “disruptive, high-impact brand.” He says, “Their differentiated products resonate with today’s consumer by addressing a previously overlooked need, opening up compelling pathways for expansion and innovation.”

Also in a statement, Fabian Garcia, president of personal care at Unilever, says, “Dr. Squatch has built a solid foundation and loyal following with highly desirable products and clever digital engagement strategies. Building on its success in the US, we are excited to scale the brand internationally and complement our offering in the fast-growing men’s personal care segment.”

Terms of the deals weren’t disclosed. The publication Women’s Wear Daily reports that Dr. Squatch’s annual sales have exceeded $400 million. Last year, Reuters reported the brand hired investment banks Raymond James and Centerview Partners to seek a $2 billion exit when its earnings before interest, taxes, depreciation and amortization (EBITDA) were about $90 million, putting its EBITDA margin at around 20%. The Financial Times pegged Unilever’s deal for Dr. Squatch at $1.5 billion.

Dude Wipes CFO and co-founder Jeff Klimkowski informed Beauty Independent that the brand wasn’t on the market before receiving an inbound inquiry from TSG Consumer in January. That inquiry prompted it to sign on investment bank Harris Williams as its financial advisor for the deal. Lazard was TSG Consumer’s financial advisor. Klimkowski says, “This was not a process in the traditional manner. This was an opportunistic thing where we aligned.”

On the social media network LinkedIn, Drew Fallon, co-founder and CEO of profit planning platform Iris Finance, speculates that there’s a “good chance” Dr. Squatch’s EBITDA multiple has topped the around 20X EBITDA multiple L’Oréal paid in its $2.5 billion deal for Aesop in 2023. That multiple would make Dr. Squatch’s purchase price roughly $2 billion.

Fallon points out that Unilever is nabbing Dr. Squatch as Axe has faltered, and the conglomerate’s turnover growth in its personal care segment dipped 1.5% in its last fiscal year, although underlying sales growth was up 5.2% for the segment. He writes, “Effectively subbing in Dr. Squatch for Axe makes a ton of sense.”

“The average joe still appreciates products made by and for men.”

The Dr. Squatch and Dude Wipes deals pick up on M&A momentum in beauty and personal care. A little over a month ago, Church & Dwight announced it was buying Touchland for up to $880 million. Shortly thereafter, E.l.f. Beauty announced its $1 billion takeover of Rhode, and L’Oréal joined the M&A action with a $1.1 billion deal for Medik8 announced on June 9.

Eric Martindale, founder of digital commerce company Elite Commerce Group, says, “For the last few years, investment in CPG had really slowed down, and money is moving again. I don’t think we will ever go back to the wild, wild west of free money flying all over the place—I refer to that era as the era of irresponsible money—but I think the drought is over.”

Courtney O’Brien, founder and managing director of boutique brand consultancy The Outlier Initiative, describes Dr. Squatch as “Axe for the younger generation.” Her 14-year-old son uses its soap and, along with its branding, its ingredients are a draw. Dr. Squatch characterizes its products as 98% to 100% naturally derived, and it avoids synthetic fragrances.

O’Brien says, “He thinks it’s cool, and even my husband uses it, which gives it that masculine stamp of approval…Dr. Squatch is a brand that resonates with a lot of different ages, and it doesn’t have the exact same positioning as Axe in terms of blatantly selling sex appeal, but it does appeal to the same teenage demographic.”

According to digital intelligence platform Similarweb, Dr. Squatch’s audience on its e-commerce website is about 60% male and 40% female, and its core demographic is digitally savvy 25- to 34-year-olds. The brand sells more than 30 items, including bar soap, body wash, deodorant, shampoo, conditioner and cologne. Available at Walmart, CVS, Target, Safeway and Amazon, its average price is approximately $8.

Dr. Squatch has come a long way from its scrappy startup beginning. After working in technology and consulting, Jack Haldrup launched Dr. Squatch in direct-to-consumer distribution in 2012 with soaps he had hand-mixed in his garage to combat his psoriasis. The brand entered retail, specifically Walmart, nine years later.

Dude Wipes has a core demographic analogous to Dr. Squatch, and Klimkowski says its users are split evenly between men and women. Its purchasers are 70% women and 30% men. The brand has three core product lines: its signature flushable Dude Wipes, air freshener and cleaner Dude Bombs and Lil’ Dude Wipes for children, a Walmart exclusive that launched this month.

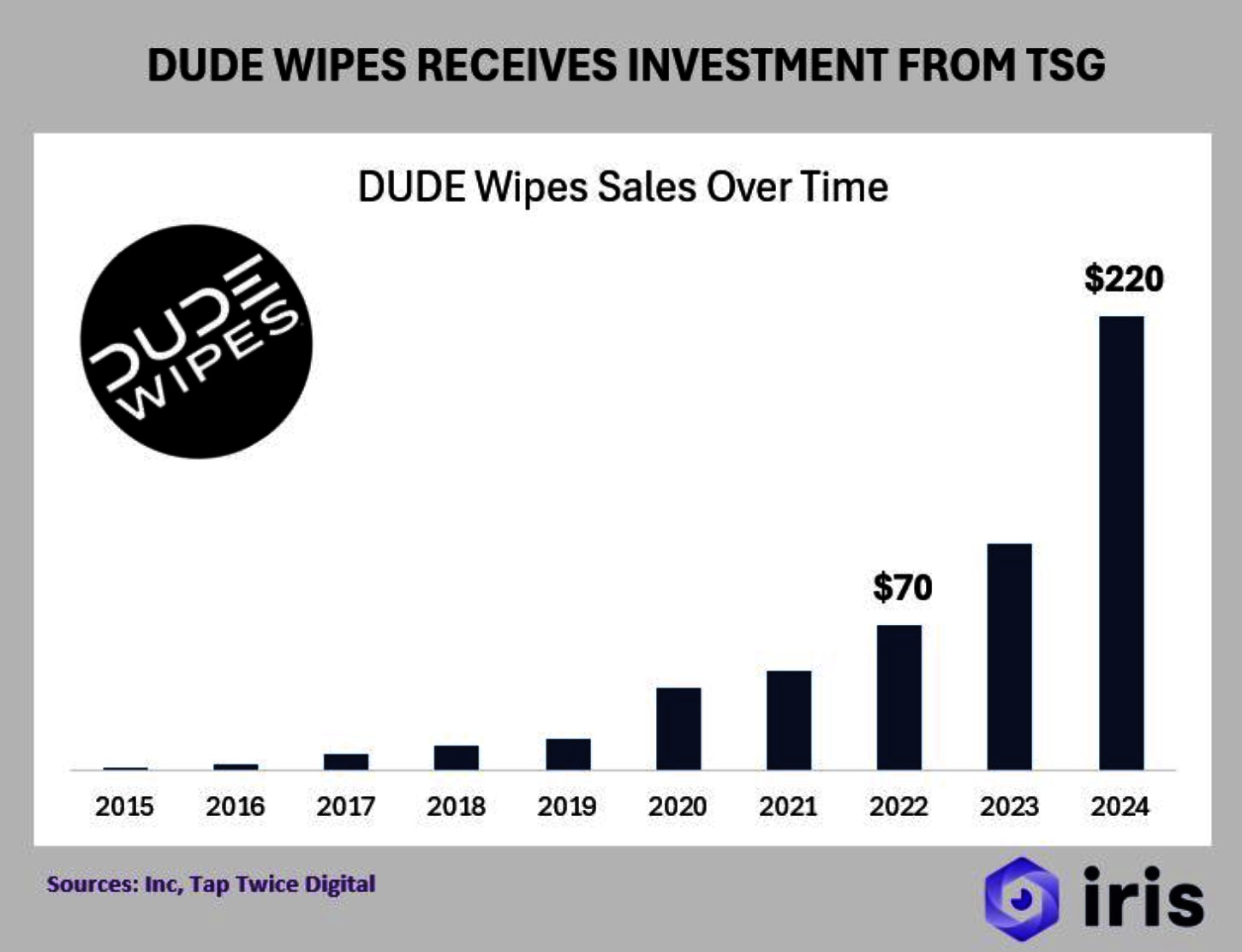

Along with Walmart, Dude Wipes is in Target, Amazon, Sam’s Club and Costco, where it’s expanding from 30 to 150 locations in the fall. On average, a three-pack of Dude Wipes is $11.29. In 2024, Dude Wipes generated $220 million in sales. The brand has quadrupled its sales volume since 2021.

Klimkowski, who was in investment banking at Deutsche Bank from 2007 to 2011, didn’t divulge Dude Wipes’ EBITDA margin, but says the brand has been profitable since 2016. Fallon estimates Dude Wipes’ valuation at $400 million to $600 million, with an EBITDA margin between 15% and 20%, giving it a multiple of 12X to 14X EBITDA.

He says, “There’s obvious demographics to expand to, and it’s a good market that some big company like Kimberly Clark should eventually acknowledge that they need exposure to, and it’s a really easy solution to just buy Dude Wipes after TSG cleans it up and grows it. It’s a large market, and Dude Wipes is obviously a winner.”

“These two acquisitions send the signal that the market is waking up.”

Klimkowski started Dude Wipes in 2011 with his childhood friends Sean Riley, Ryan Meegan and Brian Wilkin from their apartment in Chicago. “We were going out on the weekends, and we were all hitting real jobs on Monday morning drinking coffee. Then, you go to a bathroom, and you sit in an office chair all day and you don’t feel fresh,” says Klimkowski. “So, we were solving that problem and turns out a lot of other people have that same problem.”

A willingness to take chances on bold marketing has been a hallmark of Dude Wipes. In 2014 for example, the brand paid $10,000 to UFC fighter Tyron Woodley to wear trunks with Dude Wipes written on their back during a fight. Klimkowski estimates it was 60% to 70% of the brand’s marketing budget at the time. He recalls, “As CFO of Dude Wipes, I was going nuts thinking that that was the dumbest spend in the world, and it turned out to be the best money we’ve spent.”

In its early days, venture capitalists and retailers passed on Dude Wipes. The brand crossed its initial $1 million in sales on Amazon rather than through a major physical retailer. In 2015, it got a huge break by appearing on the ABC reality pitch contest “Shark Tank.” Mark Cuban, a “shark” or investor on the show back then, injected $300,000 into the brand for a 25% stake. He exclaims it’s the best “Shark Tank” investment he’s ever made.

Until TSG Consumer, Cuban was Dude Wipes’ only outside investor, per Klimkowski, and he remains on the brand’s board. Klimkowski, Riley and Meegan retain significant ownership and are staying involved. Klimkowski says, “This isn’t a VC pump-and-dump-type story. This is one where we’ve been building brick by brick real consumer demand. We’re creating a category. While you’re creating a category, you need to invest. We have a heavy 5-year investment plan.”

Eighty percent of Dude Wipes’ wipes are manufactured in the United States, and the rest are manufactured in Europe. The brand aims to be made completely domestically within five years. In 10 years, it aims to grow its household penetration from 35% to 70% and its market share in the bath tissue sector from slightly under 2% to 8%.

Dude Wipes extended to soaps and deodorants in the past, but discontinued them to concentrate on wipes. Next up for the brand is adult incontinence. Klimkowski explains Dude Wipes reached out to the youngest of audiences with Lil’ Dude Wipes and will widen its net to older audiences with adult incontinence merchandise.

Benjamin Bernet, founder and CEO of men’s brand Bravo Sierra, views the Dr. Squatch and Dude Wipes deals as part of a wave of acquisitions of DTC men’s personal care and grooming brands birthed in the 2010s. He lumps Dollar Shave Club and Harry’s into that group. Unilever acquired Dollar Shave Club in 2016 for an estimated $1 billion and offloaded control of it to Nexus Capital Management in 2023. Edgewell Personal Care Company’s nearly $1.4 billion acquisition of Harry’s was blocked by the United States Federal Trade Commission in 2020.

Bernet says Dollar Shave Club’s ruinous run at Unilever, where it was hampered by tight margins, a culture mismatch and a softening shaving business, and the blocked Harry’s deal “put a chill through the men’s grooming mass market category for the past five years. Now, these two acquisitions send the signal that the market is waking up, and that there are attractive targets out there. It’s good news for the category.”

He continues, “These acquisitions are rebalancing the category, putting more market share back into the legacy conglomerate, Unilever, and away from the independent guys. I guess we’re back to the pre-2010s in a sense…In my opinion, these acquisitions will only accelerate that shift as the mass market is once again becoming an oligopoly of large companies with very deep pockets and more hostile to emerging indie brands.”

Jared Pobre, founder and CEO of the men’s skincare brand Caldera + Lab, says the deals “showcase the widening market appeal and growing interest in the men’s category…men’s self-care has not scratched the surface of its full potential.”

Looking ahead, he expounds, “We are seeing shifts that the women’s segment saw in previous years: a focus on clinical results and evidence-based products, increasing consumer interest in ingredients and a willingness to invest in skincare that addresses his unique concerns. Male consumers are purchasing for themselves more, as evident through the growth of brands like Dr. Squatch and Dude Wipes.”

Dude Wipes and Dr. Squatch built their businesses on entrepreneurial risks. A danger they face going forward is that their appetites for risk could diminish as they become responsible to larger players. TSG Consumer has $13 billion under management, and its portfolio includes beauty companies Summer Fridays, Radiance Holdings and Hempz. Unilever has over 400 brands in its portfolio and registered $65 billion in sales last year. It’s trying to streamline by divesting smaller assets.

O’Brien says, “The challenge as you scale is, how do you maintain what made you edgy and attractive in the first place? The biggest risk is making it vanilla, and it stops appealing to the people that made it popular.”

Click here to secure Early Bird tickets to Dealmaker Summit happening November 10 to 11 in London.

Leave a Reply

You must be logged in to post a comment.