Why Wittington Ventures Is Leaning Into Consumer Investments As Other VC Firms Do The Opposite

In Canada, it’s hard to escape the impact of the Weston family. From a single Toronto bakery established in 1884 by American-born entrepreneur George Weston, it spawned aptly named George Weston Ltd., a multibillion-dollar publicly traded retail colossus including more than 2,400 Loblaw stores and 1,300 Shoppers Drug Mart stores. Canadians visit Loblaw locations over 1 billion times a year, and it’s the largest private sector employer in Canada with 200,000-plus employees.

Five years ago, the Westons’ family office created Wittington Ventures as an independent venture capital firm informed by and informing its retail properties. The firm started assembling a portfolio focused on climate, commerce, food and healthcare, but it’s increasingly interested in beauty, health and wellness businesses. Among its investments representative of that interest are beauty-centered biotechnology company Arcaea and virtual healthcare provider Thirty Madison.

Qasim Mohammad, director at Wittington Ventures, tells us the firm seeks to finalize two to three investments annually. It targets companies across stages and typically writes initial checks of $3 million to $5 million, with follow-on investments having similar check sizes.

“The thing with Wittington that I love to emphasize to founders is I wear two hats when a founder pitches us,” explains Mohammad. “One is, of course, can this be a great consumer investment for us? But, also, if it doesn’t make sense, potentially we’re a great conduit to get introduced to some of these great merchants.”

Beauty Independent asked Mohammad to elaborate on the attributes he’s looking for in consumer companies, why he’s pursuing consumer companies now, the beauty of Shoppers Drug Mart’s beauty assortment, masstige’s business appeal, what beauty brands should understand about the Canadian market, and whether the next Glossier could be built on TikTok.

What more should we know about Wittington Ventures.

The genesis of the fund was twofold, one being to drive venture returns for our LP by making great investments in tech and consumer, and secondly to do it in a way that’s tangential to the core assets of the family in retail, health, wellness and luxury.

Over the last five years as a firm, we’ve done a really excellent job of finding companies that not only represent great standalone venture investments, but also allow us to tee up what we like to call win-win scenarios. What better outcome than to be able to write a check in a business, but to also tee up some advocacy within our LP base?

Examples of that would be one of the retailers excited about carrying a product from a consumer business we’ve invested in with, of course, that decision being entirely under their purview. We’re not a corporate VC by any means, but it’s a symbiotic relationship. The LP base gets a great amount of insight from us being in the trenches talking to startups, and we are able to provide insights to founders as it relates to the Canadian market.

What are elements of the Canadian market they tend not to understand?

There are a lot of nuances to the Canadian market that beauty founders don’t entirely understand in the early innings of their business journey, but which become much more important down the road like, if you sign an exclusivity with Sephora in the U.S., it usually extends into Canada, which precludes you from maybe selling to other retailers such as Shoppers Drug Market, which has five times the number of doors in Canada than Sephora.

When you’re selling to consumers here, it’s like 10 different markets in one. The Francophone market is very different from the GTA [greater Toronto area], which is very multicultural and has a much larger East Asian community. When merchants are planning their product calendars, it’s just a very different way of thinking about that market.

There’s been a move away from consumer brands within the VC world. What do you make of that?

We’ve been looking more. We’re relatively new on the block, so we’re building that pedigree. There’s a counter narrative right now within consumer where, because everyone’s essentially run for the hills, there are exciting opportunities to back great founders at extremely favorable valuations.

Coming out of COVID, there was a lot more access to capital. If at any point in time the market enters a cycle where that access to capital dries up, a brand can enter a death spiral, and it’s a really scary place to be. What’s exciting in this moment in the cycle is that it has forced companies to really think through their P&Ls, and for the founders that are able to get to the other side, which predominantly means being profitable and having the runway to survive, there are great opportunities for investors to be intentional about and pick up the best ones at very favorable valuations.

Forerunner came out with a report about how consumer companies are just as likely, if not more likely, than enterprise software companies to exit, but the term “consumer” was used in such a way to include consumer internet as well. If you pare back the probabilities of success in consumer versus other verticals, it’s just as hard, but you don’t necessarily hear about them as much in tech circles because the audience that’s investing is not as familiar with that world. But I think now is a really good time, and I’m out in the market looking for cool stuff.

As Arcaea illustrates, science-related businesses are of particular interest to Wittington Ventures. What does science mean to you in terms of how it translates in a brand?

Functionality that’s never existed before. We’ve heard about hyaluronic acid and vitamin C, these are great ingredients, but we saw an opportunity for a wave of new nomenclature to be introduced in the marketing and copy that gets people excited about capabilities that frankly never existed before in their personal care products.

Science also means education. A lot of brands are launching things that are science backed, but if you’re not over-communicating, there’s a huge chance that your message isn’t landing. A lot of brands, when you go to look at their socials, there’s no mention of the medical communities or advisors on their science boards that help them formulate.

One of the things I’ve leaned into more is, it’s not just about having the science, but knowing how to communicate it. Half the battle is doing a good job of sharing information with a customer that isn’t up to speed yet.

Wittington Ventures tends to invest at an inflection point for a startup. Some early-stage investors in beauty zero in on a big retail purchase order as an inflection point. Is that what you’re looking for?

The biggest inflection point in consumer is around an unfair distribution advantage, and it’s kind of ironic to say that because an investor can help deliver it. In those cases where there’s an inflection point driven by a big retailer, obviously that is exciting, so when we’re doing diligence on investment opportunities, we lean into the expertise of our corporate partners to understand, as buyers, how are they thinking about this business?

The first thing I do with any sort of investment I look at is to try to loop in our partners to see their thoughts on it, and then we start a collaborative process to figure out, how do we want to move this across the funnel? Distribution by way of celebrity I think is interesting, too, and also in terms of science. You can have the best ingredient, but you’ve got to be able to tell a good story around it.

We’ve seen some stumbles from celebrity beauty brands of late. Why are you optimistic about celebrity brands?

When it works, it works like with any other consumer brand business. We’ve seen enough examples of unicorns within celebrity that would reflect a percentage of success that’s relative to your probability of success in any other category as a standalone founder without a celebrity. It’s just hard to predict whether you can get to that outcome considering there are nuances to celebrity brands you don’t necessarily have control over, the celebrity being one of them and their inclination towards the business.

I think the challenge is, because it’s so easy and seductive to find a big name and everybody has this desire to attach someone to something because they think they can get an instant hit, it takes away from what can be magical. With any investment as an investor, you want to be judicious about what you back, but I think it can work out really well.

In beauty, Shoppers Drug Mart is a leader in commingling mass and class under one roof. Can you fill our predominantly American audience in on the chain?

I can’t speak on behalf of Shoppers officially, but as somebody who’s tied to it from a Wittington perspective and frankly as a customer, the first thing about Shoppers that’s so exciting is the fact that we have over a thousand doors across the country. It is such a big part of Canadians’ lives. A day does not go by where a huge chunk of our population isn’t interacting with one of its doors.

The beauty boutique part of the store is a very elevated experience that goes toe to toe with Sephora. You walk in and see the big brands have gondolas and sections. Shoppers has done well staying on top of the brands that become really hot in other parts of the world or even in Canada and being able to offer that to customers.

Outside of the beauty boutique, you’ve got a whole section for mass, and there’s a whole area for health and wellness. It is a really all-encompassing destination. One thing that I always hear from the Shoppers’ team is they’re so proud that it’s an experience that speaks to all age groups. They’ll have mothers and daughters coming in together.

How do you see the interaction between wellness and beauty?

They’ve become so synonymous. Toronto is an interesting city where you’re seeing many interesting four-wall concepts that speak to the complete extent of services that customers expect when it comes to their wellness journey. Inside-out beauty is back in vogue, including the likes of probiotics and collagen, and gut health and its impact on the rest of the body. This time, it’s backed by science, and it’s a trend we’re keen to make an investment in.

Otherwise, travel is a big part of wellness, and there’s a huge intersection between beauty and travel. People are experiencing brands in a hospitality setting. This is a theme that’s coming up in many different verticals, not just beauty, but in fashion. That’s a trend we’ve been staying close to as well.

Post-DTC reckoning, how do you think about the role of DTC in the brands you evaluate?

We have to see the ability for a brand to be truly differentiated in three ways: a compelling story, a technical moat and an unfair distribution advantage. If you’re just DTC, you’ll never be able to hit on the third piece.

We’ve steered clear of investing in DTC-only brands unless, of course, we can see an opportunity to get those brands to evolve such that their story resonates in a four-wall setting, too, whether that’s retail or a hospitality or health and wellness setting.

I find that there’s a bit of an exhaustion among customers with just experiencing brand online. Of all the brands I can think of in beauty that are hot or have captured people’s interests, they’re doing really good stuff in real-world experiences.

What are four-wall beauty concepts you’re watching?

Rennai is going to be really exciting. It’s an immersive beauty experience. Former Holt Renfrew executive [Christopher Novak] is launching it. Formula Fig is another interesting one doing cool things. Especially with four wall, there’s nothing wrong with slow and steady growth. There are great examples of companies such as Erewhon that have done that.

Masstige has been the fastest-growing beauty segment in the United States. What segment is most compelling to you?

For me, masstige is the most exciting because there’s an aspirational element to it that can get people excited, and it has a better margin profile. With respect to mass, I don’t know if I’ve seen as much innovation. There’s so much noise, and you’re competing with big incumbents that have the supply chains to introduce something that’s complementary or competitive relatively quickly.

If you’re in mass, there’s always that risk of, what are the big guys going to do? Can they come out with something and use their big marketing budgets to blow me out of the water? And the bigger players in retail keep the lights on for stores.

Masstige allows you to experiment with interesting channels, lean into the aspirational aspect and have higher price points and margins without some of the pressure that comes with going full-blown prestige. Masstige is the area I hear most people, especially in the investment community, placing bets around or feeling more optimistic.

Prestige is exciting, too. If you look at what Dr. Sturm did, for example, something like that is interesting, but you have to really know your customer well and have a really believable story.

Could the next Glossier be built on TikTok Shop?

I think so. I say that based off what I see certain brands doing TikTok, and being in the trenches I’m appreciating how important of a channel TikTok is becoming for founders in all sorts of verticals. I am a 100% bullish on TikTok, and it’s not from conjecture. It’s from what I’ve heard on the ground of the growth being driven through that channel if you know how to use it.

What key performance indicators are you honing in on as you vet consumer companies?

The biggest one is repeatability of purchases. Nothing says to me that a brand is good and exciting more than the same core customers coming back to it nonstop.

Beyond that, how those margin profiles are informing basket sizes of orders, how those basket sizes are relative to the cost of acquiring that basket and the cost of acquiring that customer. Especially given the climate in which we find ourselves, brands that can lean into subscriptions and show loyalty, that’s the hallmark metric.

In the beauty industry, Sephora is viewed as a deal kingmaker in that beauty brands that have exited often wind through the beauty specialty retailer. Do you think that will continue?

That’s probably not going anywhere, but I feel there’s an exciting opportunity for brands to think bigger and outside of the box. If they can be a bit more inventive with distribution, they don’t have to be beholden to Sephora.

That goes back to what I was saying with thinking through hospitality as a channel and health and wellness on the clinic side. I think not enough brands have really explored those channels, which is kind of ironic because more healthcare professionals are trying to enter beauty.

Of course, Sephora is huge. If you can master a $10 billion-plus sales channel, you’re obviously going to end up with outcomes that are really interesting, but the market is very crowded with a lot of brands taking very similar approaches.

The question to ask yourself is, what can you do that’s different? What are other channels where you can establish a moat around to say to a potential acquirer, we’re the best at X and no one else has really figured out how to crack this nut? Founders shouldn’t preclude themselves from dreaming big.

For a typical brand, how can its cost structure be improved?

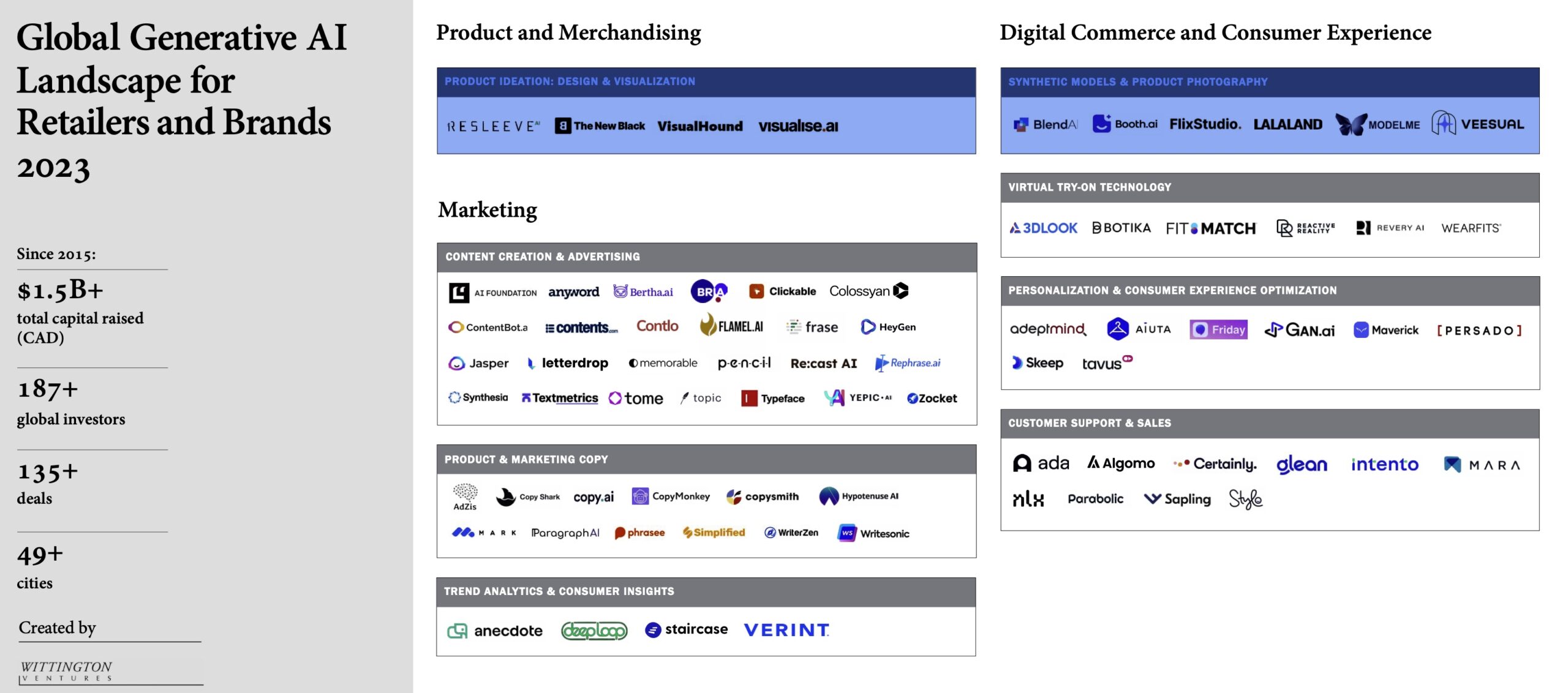

They’re letting go of full-time staff for certain functions such as marketing and outsourcing, especially at the earlier stages, dabbling more into AI to do a lot of that. There’s a huge explosion of companies that will do marketing for you completely automated.

Whether it’s good, that’s up for debate, but if you can use that and augment it with a consultant and save on three full-time employees, that might be what, $80,000 a year each? If you’re a brand that’s doing $2 million in top line right now, it’s a huge percentage of revenue you’re saving. Founders are going back to more founder-driven sales and activities because you have to double up when times are tough.

The second one would be distribution. For example, how do I start building relationships with people that can get my brand out in a more analog fashion? You can’t always plan for virality online. It is so expensive now, too. We’re definitely seeing the pendulum swing back to introductions to buyers, introductions to people at different trade shows. How can I just get my name out?

Leave a Reply

You must be logged in to post a comment.