“Custodians Of Capital”: How Corporate-Aligned VC Funds Bold Ventures, Access Ventures And Unilever Ventures View Their Roles

The venture capital arms of major consumer packaged goods companies want to set the record straight on common misconceptions about them.

They may be largely unencumbered by the burden of fundraising, but that doesn’t mean they can afford to spread cash everywhere without the possibility of financial return. If anything, they must be even more discerning than traditional VC firms, according to Rakesh Narayana, GM at Access Ventures, the VC arm of Reckitt.

“The reality is that our job, first and foremost, is to be custodians of capital,” he said. “So, it is a choice that the company makes, and it’s a choice that we fight very, very hard for.”

Narayana joined Rachel Weiss, VP at L’Oréal’s VC arm Bold Ventures, and Olivier Garel, managing partner at Unilever’s VC fund Unilever Ventures, for a Beauty Independent In Conversation webinar on Wednesday. During the webinar, Weiss underscored the role of corporate-aligned VC entities such as Bold Ventures as conduits between entrepreneurs and big established companies.

“I always remind my partners in our company that these are people who are putting sometimes their life savings on the line who can go out of business very quickly,” she says. “We have a responsibility to those humans as humans and as representatives of publicly traded companies on top of this. So, that is a really complex responsibility that I think anyone who’s in a corporate venture role takes very, very seriously.”

At Bold, Weiss is often countering the notion that an investment from a strategic-backed VC entity can limit a startup’s trajectory, particularly in the field of technology. In reality, she emphasized portfolio companies within corporate funds can unlock big opportunities. Weiss said, “If we go through the very diligent process of investing in you, you’re going to be at our global forum in front of all of our brand managers across the world. I mean, imagine if you’re a small team the amount of meeting time that you’re saving.”

Fund Facts

Launched 20 years ago, Unilever Ventures was one of the first corporate-backed venture capital firms to focus on beauty and wellness. It typically leads or co-leads funding rounds from seed up to series B. Its check sizes range between $500,000 and $15 million. Garel pegged the size of the fund to be about $350 million.

Beauty and wellness brands within Unilever Ventures’ portfolio include Rael, Straand, Womaness and Trinny London. It’s also invested in technology-centered subscription, delivery and marketing platforms like Grove Collaborative, CreatorIQ and FabFitFun. Exiting to Unilever is considered a bonus for portfolio companies. It’s not a requirement.

Garel said, “We try to help them professionalize their activity, think through their strategy, simplify their agenda and properly define their priorities like other funds would do.” He stressed the importance of Unilever Ventures seeking out companies with forward-thinking missions and new business models that will define the future.

Launched six years ago, Bold Ventures’ investment focus spans from emerging beauty brands to the companies creating tomorrow’s most sought-after tools and technology. It particularly favors technology companies that can give L’Oréal’s brands a competitive edge. Bold Ventures’ portfolio includes the brand Functionalab, salon software company Slick, biotechnology startup Debut and water filtration technology company Gjosa.

Weiss said, “We’re really looking at what the future of beauty can mean and new business models that will define beauty for the future.”

Launched three years ago, Access Ventures was born of the idea that there was a gap between enthusiastic entrepreneurs looking to disrupt the consumer healthcare space and investment to support their visions. Goldfinch, North Sky Capital, Scarlet’s Bakery and Honest Jobs are in Access VC’s portfolio. To carve out independence from its parent company, it formed a separate board of directors and became certified as a B Corp.

“That’s been a big game changer for us,” pointed out Narayana. “We’ve seen our deal flow change, we’ve seen the way we interact with our founders change.”

Narayana highlighted Access Ventures’ “culture of innovation,” a standard by which the firm’s success is measured. He said, “How do we run mentorship programs? How do we bring some of these companies to work with us in partnership? A lot of this intangible work is a big measure of success.”

Brand Evaluations

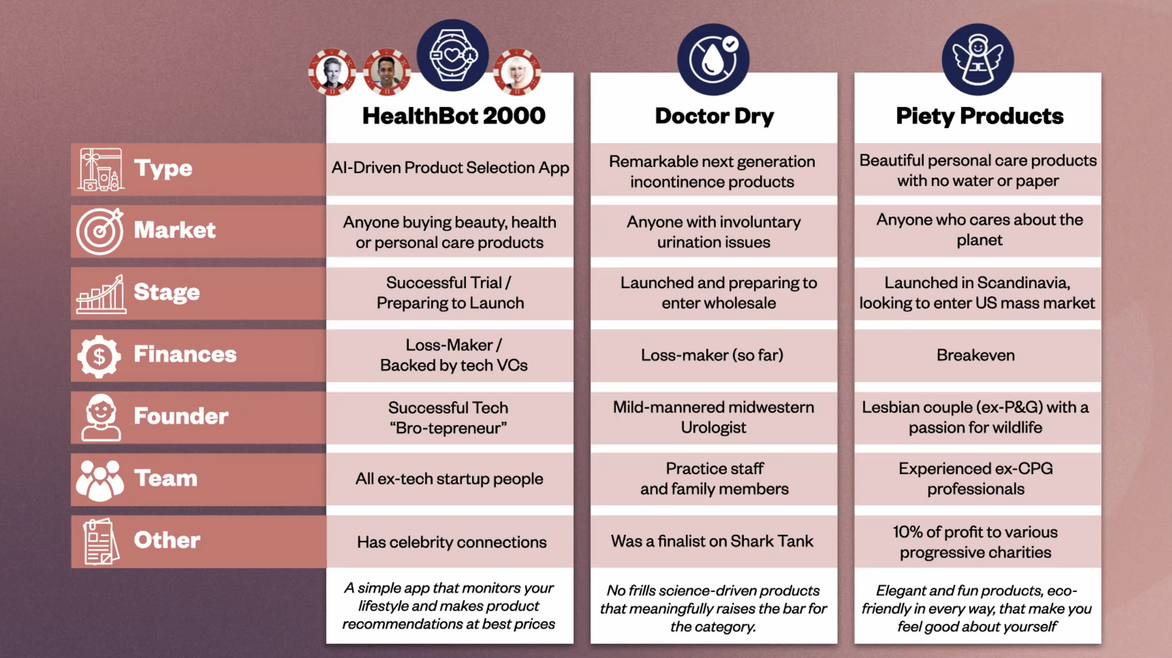

During the webinar, Weiss, Narayana and Garel participated in an exercise in which they evaluated the hypothetical brands HealthBot 2000, Doctor Dry and Piety Products for investments. HealthBot 2000 was defined as an artificial intelligence-powered app that curates unique and affordable product offerings. With a bit of funding in place from technology-oriented venture capitalists, the app is about to launch.

Doctor Dry was characterized as a consumer products company driven to develop next-generation solutions for people battling incontinence. Founded by a doctor, the brand is gearing up to launch into retail. Piety Products was depicted as a sustainable personal care brand founded by two former beauty corporate executives looking to break into the mass market in the United States.

Here’s what Weiss, Narayana and Garel said about the faux brands:

Weiss: “Doctor Dry is really defining a new category of what beauty could be and mean in something that would be a new business model. Piety Products meets our sustainability goals. I have a lot of questions of how they’re building that and what that means, but that is directly aligned with many of the things we’re looking at for L’Oréal. With Healthbot, seeing something that’s foundational AI that could be easily replicated. I don’t know if that company would be around in a year or so. That’s my concern, but I would likely have to meet with them first.”

Narayana: “I like HealthBot because they have the ability to reach the most number of people. What I don’t like about them is whether it’s built as a really purpose-led business and if it will stand the test of time. What I like about Doctor Dry is it’s a subject matter expert who’s really built something. His ability to run a business would be my big question. I love Piety Products’ angle of sustainability. The question I would have is whether it is a very expensive brand. People of this sort of background usually tend to build super high aspiration products, which maybe 1% of the world can afford. I would probably pick HealthBot 2000 to meet first.”

Garel: “I would certainly go for a meeting with HealthBot after checking the profile of the founder online and trying to understand the background. It seems to be quite successful. I’d honestly take a first meeting with each of them. I would just ask what the level of revenue is so far. With Piety Products, I suspect that if they’re already at breakeven and launching in the U.S., they must have reached a very decent scale already. Doctor Dry would certainly be a bit out of scope for my funds, but I’m very intrigued with the strength of the technology they have developed.”

Leave a Reply

You must be logged in to post a comment.