Decoding RoC Skincare: The Science Of A Lasting Beauty Brand

In today’s beauty market, where modern brand builders are challenged by fierce competition, lightning-fast trend cycles and shrinking customer loyalty, scaling a successful beauty brand that will last the ages is no small feat.

And then there is RoC Skincare. With a product purchased every five seconds in the United States, RoC has become one of the most in-demand skincare brands in the world’s largest beauty market. Developed and refined over 65 years, RoC has built that success brick by brick by positioning itself at the forefront of clinically tested and dermatologist-approved skincare.

RoC matters because it has effectively addressed three of the most common challenges facing brands today.

-

- Building a Scalable Innovation Pipeline: Today’s skincare market is more competitive than ever, and there’s no shortage of places to invest when it comes to new product development. The question then becomes, how do brands prioritize their innovation strategies and bring them to market? RoC has been able to both innovate and commercialize the innovation in a systematic way to build its portfolio. Keeping science at its core, the brand has adopted a first-to-market approach with product development that has endeared it to customers for generations. Key innovations include the first hypoallergenic cosmetic product and the first shelf-stable retinol product.

- Balancing Growth and Profitability: Gone are the days of the “growth at all costs” mindset that dominated the direct-to-consumer boom of the early 2010s. Brands and investors are more focused than ever on achieving consistent profitability while growing top-line sales. RoC balances strong financial discipline with a solid sales performance as it contends with larger competitors on the shelves of retailers. In the U.S., RoC outperformed L’Oréal and Neutrogena as the top-selling retinol brand for the year ended in April, according to data from market research firm NielsenIQ. Globally, where it’s distributed in 16 markets across three continents, RoC’s retail sales increased from roughly $100 million to $300 million between 2019 and 2024.

- Maintaining Brand Loyalty: Brand loyalty seems like a thing of the past today, with beauty customers becoming more fickle as the industry continues to grow and fragment. NielsenIQ finds that beauty brand loyalty has plummeted 20% in the last two years. Focused on delivering efficacious, science-backed skin solutions to customers at masstige prices, RoC has been able to keep customers stickier than competitors. According to data from consumer insights firm Numerator, RoC’s customer retention rate sat at over 30% last year, higher than competing drugstore skincare brands.

In this white paper, the first of three that will analyze RoC, we will examine how the brand leveraged science and innovation over time and different management regimes to become the skincare powerhouse it is today. Then, we will look at how RoC is perceived in the market by investors and the qualities that made it attractive to its current management team. The second white paper will provide a deep dive into the growth strategies that have defined RoC’s resurgence under private equity partners Gryphon and Bridgepoint over the past six years. The third and final white paper will explore the brand’s future and the key priorities and opportunities being targeted by its management.

RoC Through The Decades

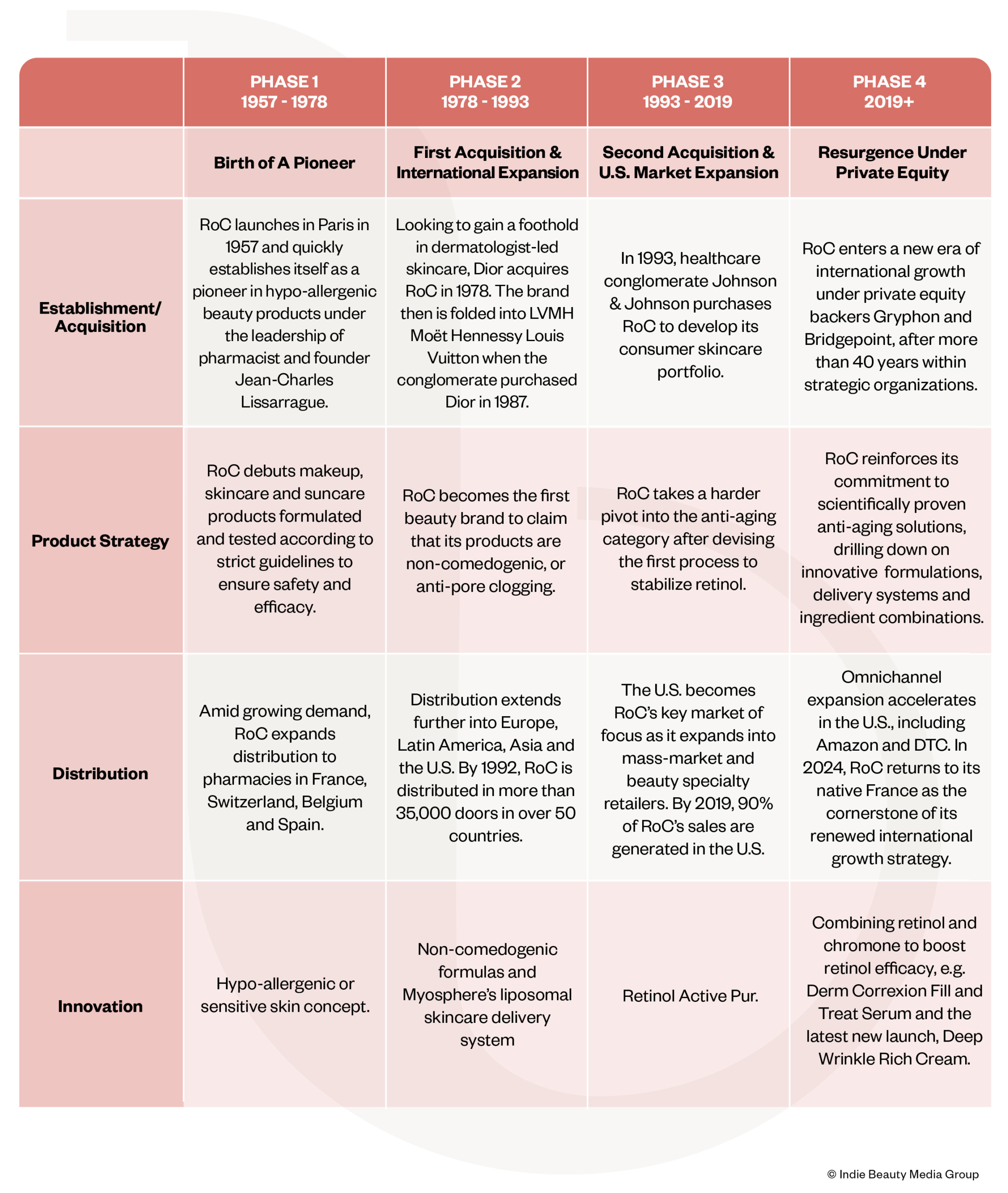

Phase 1: The Birth of a Pioneer (1957-1978)

Jean-Charles Lissarrague, pharmacist and founder of RoC, started formulating fragrance-free products for customers in the Pharmacie Rogé Cavaillès in Paris as early as 1952, according to company records and the book “Clinically Proven: From Science To Success” by Sylvie Legenne. RoC, a contraction of ‘Ro’ from Rogé and the ‘C’ from Cavaillès, was formally registered three years later and became a standalone company in 1957 when Lissarrague opened a laboratory and manufacturing facility for the company outside of Rogé Cavaillès. By that point, RoC’s line expanded into skincare to include a facial hydrating cream and a serum in addition to makeup. It also launched a broad-spectrum sunscreen called Antisolaire in 1957 at a time when tanning was all the rage.

However, what truly differentiated RoC from competitors was its formulation strategy. Honing in on the selection of ingredients and manufacturing quality of RoC’s products, Lissarrague created the concept of hypoallergenic formulas when he launched the brand.

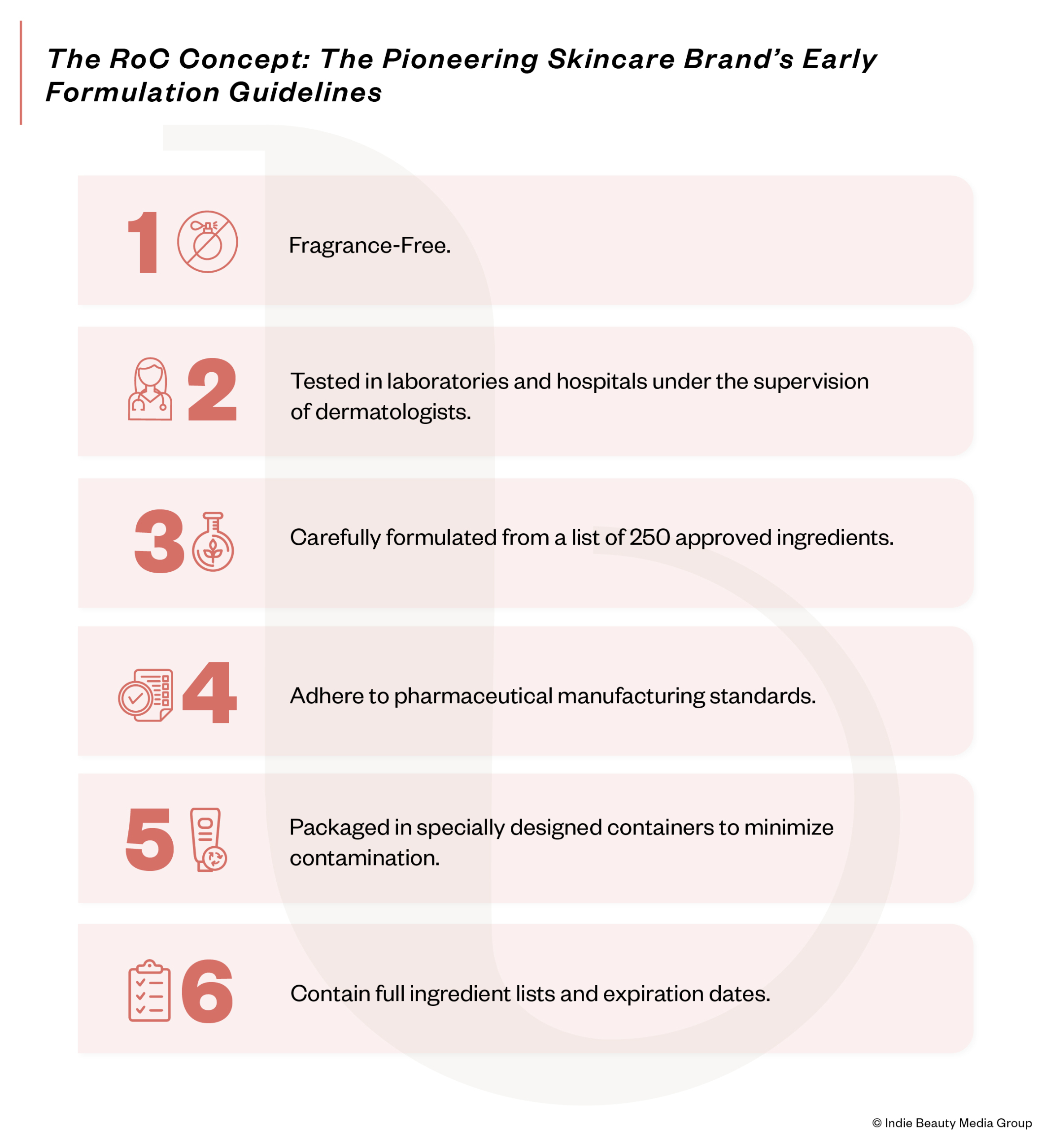

Housed under a strict philosophy referred to as the “RoC Concept,” the company’s early formulation guidelines later became table stakes in the beauty industry by the 1990s. This philosophy stipulated that all RoC products must be fragrance-free, tested in laboratories and hospitals under dermatologist supervision, and made with ingredients carefully selected from a group of 250 tested and approved options. Additionally, products were manufactured according to pharmaceutical standards and packaged in specially designed containers aimed at minimizing contamination, with full ingredient lists and expiration dates included.

RoC’s forward-thinking philosophies fueled its growth in the 1960s and 1970s as its distribution extended to pharmacies throughout France, Switzerland, Belgium and Spain. It added more skincare products like cleansing milks, toners, masks and anti-wrinkle creams to its assortment along with a men’s grooming line and an extended sunscreen line. By 1973, RoC opened a larger production facility outside of Paris in response to the growing demand for its products.

Phase 2: First Acquisition And International Expansion (1978-1993)

RoC’s expanding presence in Europe’s pharmacy channel soon caught the attention of Christian Dior, which acquired the brand in 1978 to gain a foothold in dermatologist-led skincare. Less than 10 years later, RoC’s ownership changed hands again when LVMH Moët Hennessy Louis Vuitton bought Dior from its financially struggling parent company The Willot Group.

Initially powered by Dior and then LVMH, RoC’s international distribution accelerated as its production ramped up. Affiliates in Belgium, Italy, Germany, Spain, Japan and the United Kingdom were established between 1984 and 1991 while distribution expanded into farther-reaching territories in Latin America and Asia. By 1992, RoC was distributed in more than 35,000 doors in over 50 countries across the globe and had produced more than 30 million units.

RoC entered the U.S. for the first time in 1993 through a strategic partnership with Dermik Laboratories, a developer and distributor of pharmaceutical and aesthetic products. Available in select pharmacies in New York, Philadelphia, Atlanta, Tampa, Miami, Chicago, Los Angeles and San Francisco, RoC’s early assortment in America consisted of just six products with educational and sales efforts for it focused on dermatologists and pharmacists.

Non-comedogenic, an anti-pore clogging claim that has become commonplace in beauty today, can be traced back to RoC. During the Dior/LVMH years, it became the first cosmetics brand to promote the non-comedogenic claim on its products. Hydra+, a facial moisturizer that promised all-day hydration, Myosphere, an anti-aging cream that used liposomes to deliver ingredients into the skin, and Night Repair Cream, an overnight cream that contained a derivative of Vitamin C, were a few of RoC’s most important product innovations during this period.

RoC’s Evaluation Laboratory became the most advanced in the industry under LVMH. In it, the brand utilized a scientific approach to test product performance that included direct, semi-direct and indirect methods. Its research produced some of the first before-and-after photos to be used in consumer skincare marketing.

Phase 3: Second Acquisition, Retinol Pivot and U.S. Market Expansion (1993-2019)

Eager to develop its consumer skincare portfolio, healthcare company Johnson & Johnson purchased RoC from LVMH in November 1993. At the time, RoC had 840 employees and generated roughly $500 million in retail sales adjusted to today’s currency, all of which were generated in Europe. France accounted for about 35% of the brand’s sales then.

In 1993, Johnson & Johnson’s skincare vertical encompassed brands in acne care, personal care, baby care and health care like Johnson’s Baby, Stayfree, Clean & Clear, Benadryl, Listerine, Band-Aid and ORSL. With RoC in its stable, the conglomerate saw an opportunity to amplify the brand’s embryonic U.S. business. It subsequently acquired Neutrogena and Aveeno in 1994 and 1999, respectively, to capture further skincare market share.

Unlocking their pharmaceutical synergies, RoC and Johnson & Johnson stabilized retinol for the first time in 1995 in a process that incorporated the powerful yet fickle molecule into a skincare product and protected it from oxidation. Retinol Active Pur, a retinol cream that targeted wrinkles deep below the skin’s surface, was one of the first products to debut after the brand pivoted from hydration into anti-aging and was an early success for Johnson & Johnson in France. RoC’s tagline soon changed from “Hypo-Allergenic” to “We Keep Our Promises” to strengthen consumer trust in RoC’s formulas.

Focusing exclusively on skincare, RoC discontinued makeup in the mid-1990s. Around the same time, RoC amassed over 150 clinical studies and 35 patents, 26 of which pertained to retinol, as it emerged as an expert in anti-aging formulas.

U.S. distribution for RoC expanded significantly into large-chain pharmacies like CVS and Walgreens, which gave the brand access to thousands of doors in one move. Other channels followed, including mass-market retailers Target and Walmart, warehouse club Costco and beauty specialty retailer Ulta Beauty.

However, by the late 2000s, RoC was flagging. Once mighty, its European business had declined considerably. To revitalize sales in Europe, Johnson & Johnson relaunched the brand in 2015, but the products’ overly complicated claims and messaging rendered the move unsuccessful.

By 2019, 90% of RoC’s sales were concentrated in the U.S., with the balance coming from Europe. Its in-house team was almost completely dismantled and consisted of a single brand manager who worked across brands at Johnson & Johnson at the time of its divestiture. Neglected and under-resourced, RoC’s fortunes were about to change again.

Phase 4: Resurgence Under Private Equity (2019 and onwards)

After more than 40 years under the helm of large strategic organizations, RoC entered a new phase under private equity six years ago. Gryphon assembled a new management team to kickstart RoC’s next chapter after adding the heritage brand into its portfolio in 2019.

Fernando Acosta, a consumer product goods veteran with over 25 years of experience at Unilever and Avon Products, was appointed as RoC’s CEO. Acosta details private equity was drawn to the brand’s strong global awareness, authority in retinol and clinical data and patents.

“RoC has a wonderful history with deep root strengths that somehow management, through the passage of years, simply let go,” he says. “Then came a new team with a complete commitment to nurturing those clinically proven root strengths that are as relevant today as they were back in 1957.”

Under Gryphon, RoC returned to its core pillar of creating dermatologist-recommended, clinically proven and highly efficacious products as it focused on expanding its U.S. business and reclaiming sustained profitable growth. Reenergized under new ownership, RoC skincare scaled rapidly. It caught the attention of investors at Bridgepoint as its profile in the U.S. grew in lockstep with rising consumer demand for clinical skincare. Identifying Europe as the next growth market for RoC, Bridgepoint snapped up the brand in 2024 with the intent to reintroduce it abroad, grow underdeveloped sales channels and reinforce investments in research and development.

“The company’s unique, clinically proven products for aging skin conditions are a highly appealing customer proposition with significant growth opportunities,” said Fabrice Turcq, partner at Bridgepoint, in a statement at the time of RoC’s acquisition. “With Bridgepoint’s support, RoC is poised to accelerate growth in Europe and beyond, strengthen its online presence and expand its product offering.”

RoC’s Past And Present

After over six decades on the market marked by ups and downs, RoC remains one of the industry’s leading clinical skincare brands. Its early focus on hypoallergenic products made it a standout on the shelves of European pharmacies and attracted its first buyer Dior. Recognizing the potential of what RoC could achieve, LVMH and Johnson & Johnson expanded the brand into new territories and doubled down on its scientific approach to skincare formulation.

Once heavily invested in products offering hydration, RoC turned its attention to the anti-aging market in the 1990s as it shifted focus to the U.S. market. Now in the hands of private equity backers, RoC is returning to its former glory, hyper-focused on its clinical roots as it plots reentry into key European markets and other international territories.

Relaunched in France last November, RoC aims to rank among the top dermo-cosmetics brands in the country within the next five years. It’s also ramping up its presence in Britain, Australia and in other key European markets like Italy and Spain. The second white paper in this series will examine RoC’s current strategies for growth and global expansion in greater detail.

For modern brand builders, there are several notable takeaways from RoC’s story:

-

- Brand With A Consistent Mission: With a certain degree of refinement, RoC’s core philosophies have remained remarkably consistent throughout time. The brand’s unwavering dedication to clinically tested skin solutions is likely the most important reason why it’s survived through the decades.

- The Right Team: Having the right team with the right culture in place was a crucial element in RoC’s turnaround story. New leadership brought in a fundamental shift that put the customer at the center of every decision made in the company. Execution was another differentiator. In a flat organization where everyone was collaborative, they could pivot quickly, launch products fast and navigate market shifts.

- Invest in Incredible Innovation: Leveraging its core strengths in science, RoC has managed to stay ahead of the curve when it comes to technology, innovation and even marketing. After launching the first hypoallergenic beauty product in the 1950s, it was the first to market a product with the anti-pore clogging claim “non-comedogenic.” It also created some of the earliest before-and-after photos for use in consumer marketing campaigns before introducing the first shelf-stable retinol product.

- Value Creation Through Focus: Value can be regained, but it needs the right elements in place in order to grow. Sizing up RoC, Gryphon and Bridgepoint pinpointed what made the brand’s proposition special and the opportunities it could capitalize if it operated under a new strategy. To realize those opportunities, a new leadership team was brought in to execute a new growth plan that is now seeing returns. So, the alignment of vision, strategy, team and capital is essential when reclaiming value.