La Roche-Posay Is Making The Biggest Media Impact As Science-Backed Brands Build Buzz

Science-backed beauty brands, including La Roche-Posay and CeraVe, have generated the fastest growing media impact value (MIV) in beauty this year, according to a new report by software and data insights firm Launchmetrics, ahead of mass-market, luxury, prestige, celebrity-led and indie beauty brands.

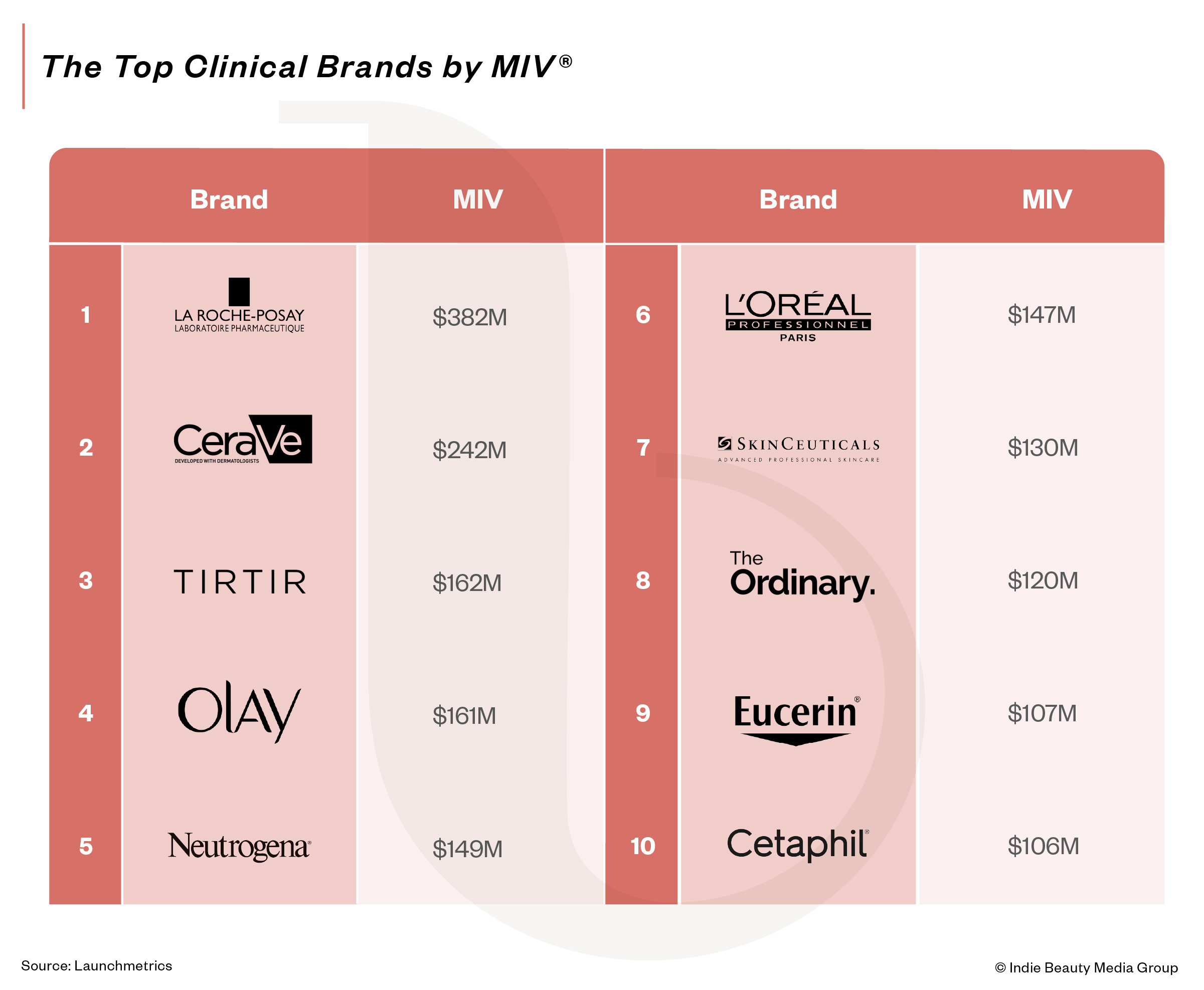

Titled “The Beauty Industry Growth Playbook,” the report pegs La Roche-Posay as the top earner in MIV for clinical beauty, generating $382 million in the first nine months of the year, followed by CeraVe at $242 million and K-Beauty brand Tirtir at $162 million. Together with Olay, Neutrogena, L’Oréal Professionnel, SkinCeuticals, The Ordinary, Eucerin and Cetaphil, clinical beauty brands grew their MIV by a collective 13%, increasing to $1.7 billion from $1.5 billion on a yearly basis. MIV is a proprietary metric that assigns a monetary value to media and communication activities across print, online and social media.

Skincare contributed the most to clinical beauty’s overall performance, accounting for 82% of the category’s MIV to makeup’s 11% and haircare’s 7%. However, haircare and makeup conversations grew the fastest during the period, clocking in at 44% and 40%, respectively. Endorsements from influencers and celebrities drove the majority of the clinical category’s growth.

Neutrogena’s tie-up with pop star Tate McRae proved especially fruitful for the legacy mass brand. It was the official skincare and makeup partner for McRae’s recent “Miss Possessive Tour” running from March 18 to Nov. 8. According to Launchmetrics, media mentions involving McRae accounted for over a third of Neutrogena’s impact across skincare and makeup.

Value-conscious customers are gravitating towards science-backed brands to get the most mileage out of their products. “This shift has also been mirrored by beauty influencers, who tend to follow consumer demand and have amplified the visibility for this category,” says Alison Bringé, CMO of Launchmetrics. “With creators responsible for driving around 61% of total category MIV, their focus on product efficacy and long-term results has significantly fueled the momentum behind clinical beauty this year.”

Media conversations around science-backed brands are increasing in lockstep with new releases. According to the market research firm Mintel, an estimated 36% of science-backed skincare launches in the past five years occurred in the last year. Strategic organizations are pouncing on the opportunity. In June, L’Oréal acquired Medik8, a science-centered British skincare brand, for $1.1 billion. SkinCeuticals, another clinical skincare brand in L’Oreal’s stable, grew revenues by a double-digit percentage last year. In late 2023, Shiseido snagged dermatologist-founded brand Dr. Dennis Gross Skincare.

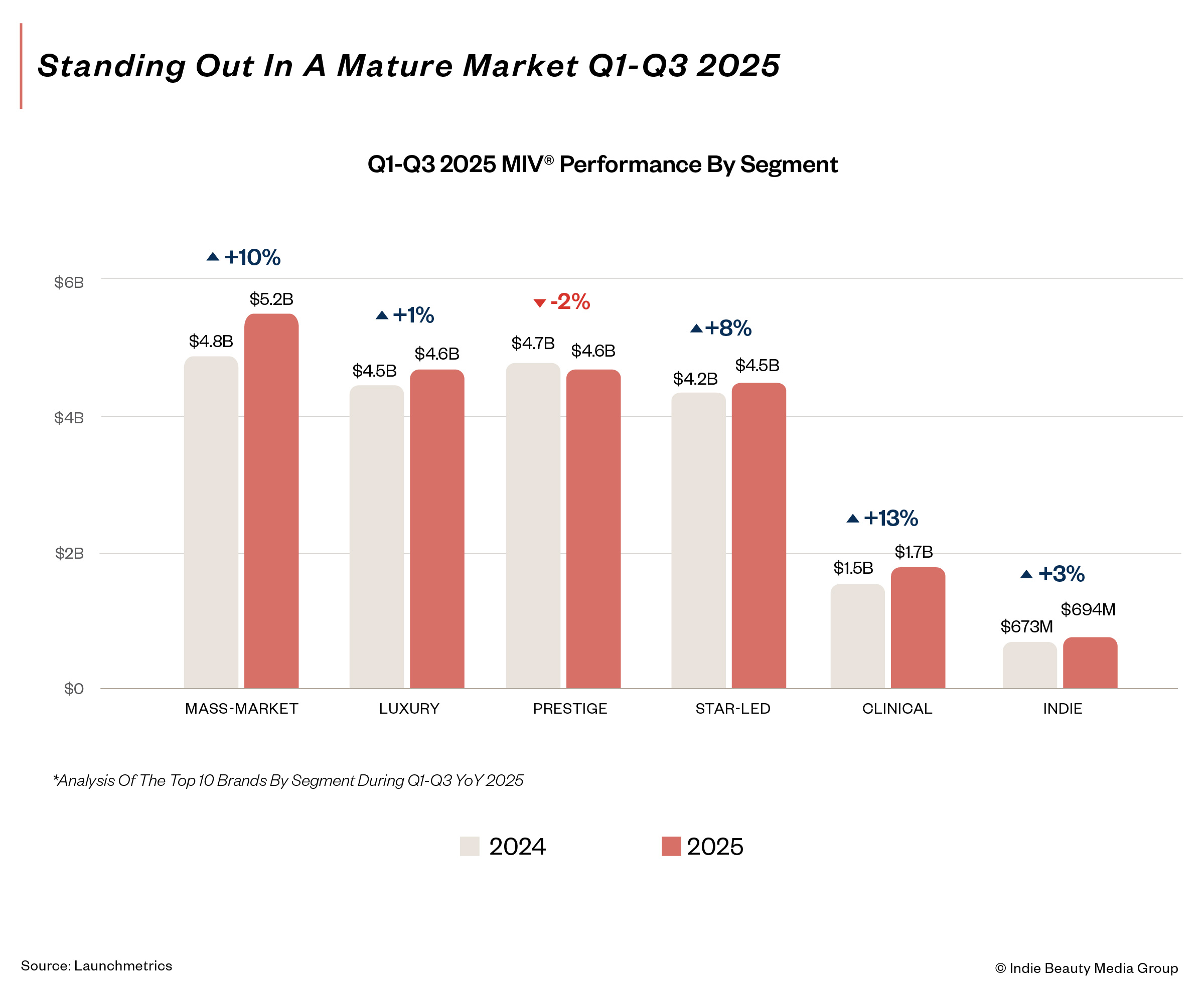

Across all beauty segments, MIV growth has hit 5% this year, down from 43% last year. Launchmetrics’ report says, “This shows that the industry is entering a more mature phase after a period of rapid recovery.”

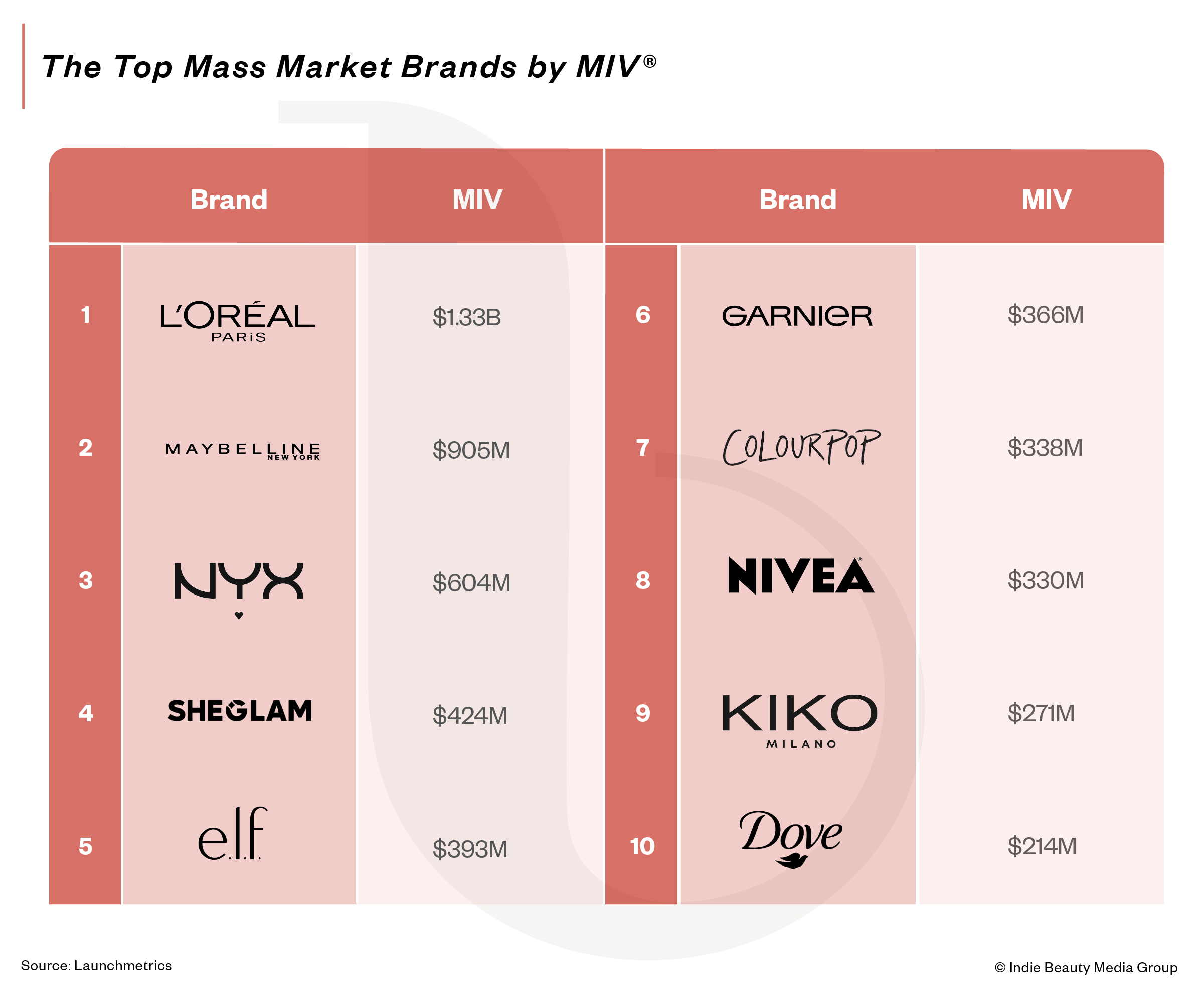

Mass-market beauty brands grew MIV by 10% in the first three quarters of the year, led by L’Oréal, Maybelline, NYX, SheGlam, E.l.f, Garnier, ColourPop, Nivea, Kiko Milano and Dove. Haircare and fragrance conversations and mentions grew the fastest, by 25% and 14%, respectively, with celebrities and retail partners powering most of the category’s gains.

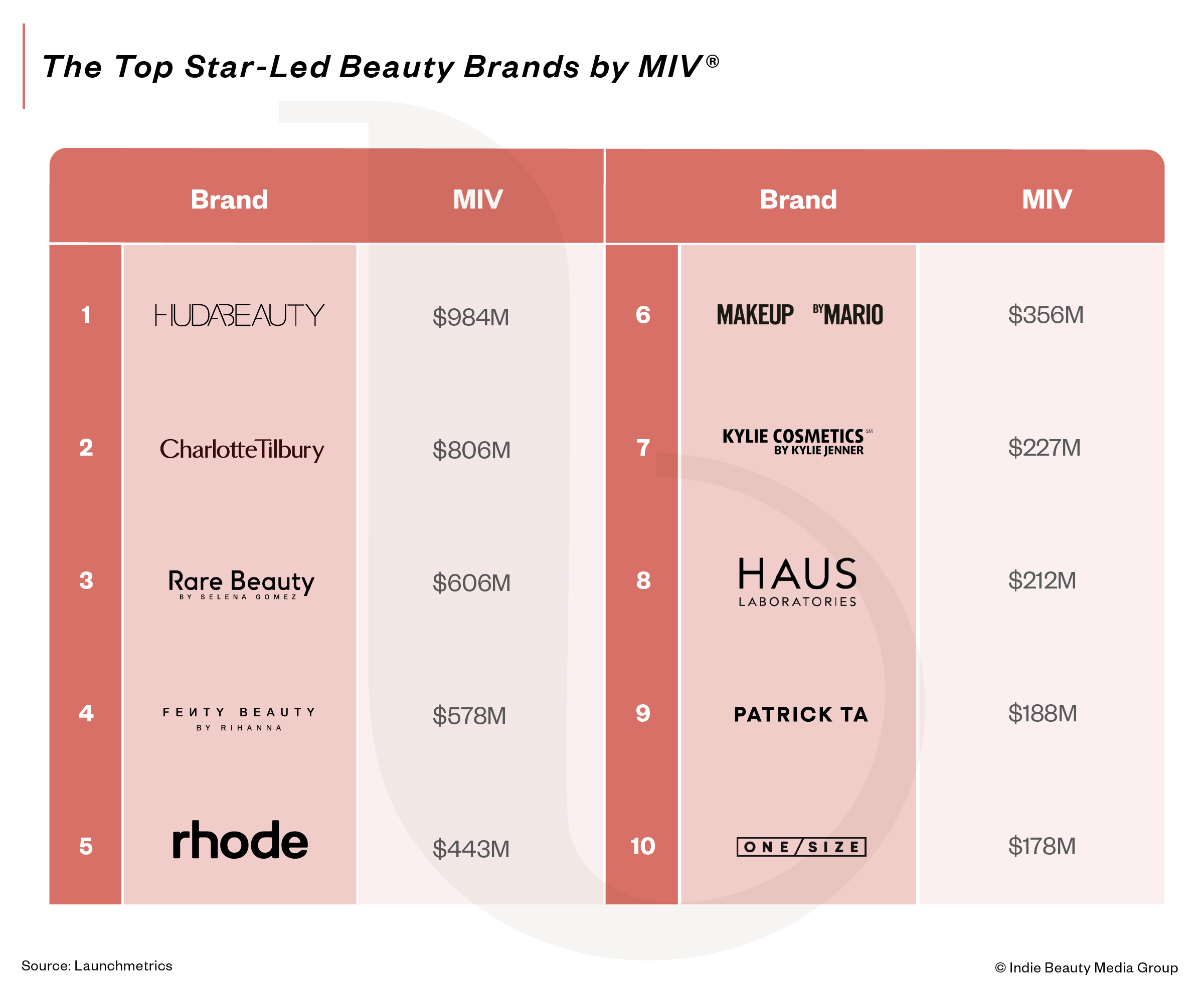

Huda Beauty, Charlotte Tilbury and Rare Beauty occupied the top three spots in Launchmetrics’ ranking of celebrity and influencer-led beauty brands for the year so far, with MIV metrics coming in at $984 million, $806 million and $606 million, respectively. Fenty, Rhode, Makeup by Mario, Kylie Cosmetics, Haus Labs, Patrick Ta and One/Size rounded out the top 10.

Collectively, the category increased MIV by 8% on a yearly basis, with skincare registering the fastest growth. MIV for makeup and fragrance dipped by 2% and 22%, respectively. Launchmetrics finds that owned media placement for celebrity-led brands is 4X higher than the average of all other beauty segments.

“Two things remain at the top of consumers’ priorities: value for money and brand engagement. That’s why mass-market, clinical and star-led brands are leading in growth,” says Bringé. “Consumers are looking to get more than just a product: they want a story, community and proof of effectiveness. Smart brands focus less on price tags and more on voices that can bridge that gap between them and the consumer, driving true resonance and lasting engagement.”

Luxury beauty’s MIV growth was 1%, reaching over $4.6 billion, while prestige beauty’s dipped by 2%. Dior, YSL, Chanel, Armani, Guerlain, Prada, Tom Ford, Givenchy, La Mer and Valentino topped the list with haircare conversations spiking by 133% during the period. MAC, Lancôme, Nars, Benefit, Estée Lauder, Make Up For Ever, Anastasia Beverly Hills, Laneige, Shiseido and Hourglass were the buzziest prestige beauty brands.

Indie beauty brands, defined by Launchmetrics as “smaller or artistry-driven brands with cult followings,” grew MIV by 3% from $637 million to $694 million. Known for its embossed details and intricately designed packaging, Chinese makeup brand Flower Knows was the top indie brand by MIV this year, registering $160 million. Sonoma Brands- and L Catterton-backed Merit Beauty placed second with $116 million in MIV, and British makeup brand and TikTok favorite P.Louise came in third with $80.7 million.

Mehron Makeup, Danessa Myricks, Made By Mitchell, Kaleidos, Karite, Lush Cosmetics and Nabla rounded out the top 10. While makeup constitutes the largest portion of the category’s MIV at 88%, haircare and skincare grew the fastest at 55% and 30%, respectively. Traditional media and editorial coverage powered the segment, rising 39% year-over-year.

As artificial intelligence starts to reshape how customers buy and discover products, Bringé suggests emerging beauty brands prioritize community building and develop diversified strategies to reach their audiences. “AI can be a powerful ally here, helping brands map not just who drives engagement, but why. In an environment where discovery and conversion are increasingly automated, human connection and trust become the true differentiators,” she emphasizes. “It’s no longer just about pushing content or product, it’s about using technology to sustain relationships and nurture advocacy over time.”