J.P. Mastey, Who Made Grooming Covetable At Baxter Of California, Is Doing The Same For Natural Deodorant With New Brand Corpus

During his tenure as owner and president of Baxter of California, J.P. Mastey made premium men’s haircare, skincare, shave, body and lifestyle products chic and desirable through modern retro packaging, memorable scents and cutting-edge collaborations with the likes of Colette, Stussy and Unionmade.

Three years after departing the brand, which he bought in 2000 and sold to L’Oréal in 2013, Mastey has returned to the beauty industry with Corpus, a unisex natural deodorant startup that could do to the odor-busting business what Baxter of California did for the men’s category: Render it eminently cooler and higher-end.

“When it comes to design, I think people covet beautiful products,” he says. “On a shelf with other natural deodorants, I would say ours is the most covetable.”

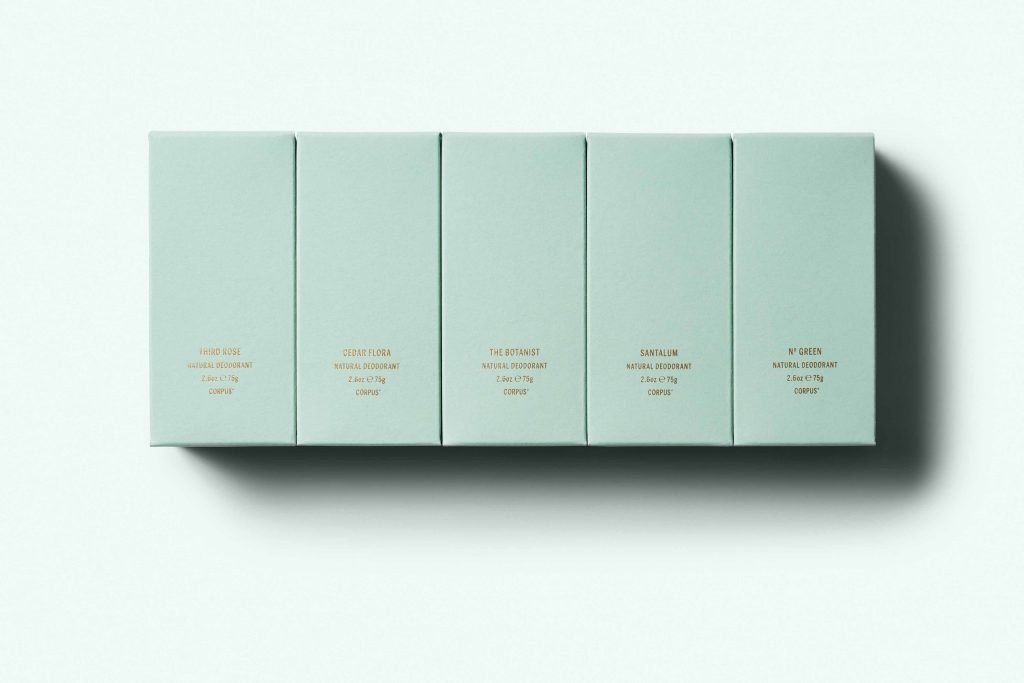

Corpus’s green design distinguishes it from the ballooning aluminum-free deodorant hoards. The brand houses its deodorants in recyclable mint green plastic cylinders with gold lettering and takes serious steps to be sustainable. Its products are manufactured domestically in facilities relying on renewable hydroelectric and solar energy.

Baxter of California’s signature color is blue. It’s no coincidence that Corpus has a signature color as well. “I learned a lot from my Baxter days. At some point, customers were calling our bottles Baxter blue. We owned the brand color over time,” says Mastey. “I love minimalist, simple, clean design and the best way to do that sometimes is to go black and white, but, as far as being an identifiable and recognizable brand, I wanted to adopt a color.”

Corpus’s color draws eyeballs, and its $22 deodorant’s five scents – No. Green, Santalum, Cedar Flora, Third Rose and The Botanist – are intended to captivate noses. The scents are naturally derived from combinations of essential oils and isolates. Dissimilar from generally straightforward deodorant scents, Corpus’s scents have perfume-style base, middle and top notes. No. Green’s notes include bergamot, pink lemon, orange blossom and cardamom, and Santalum’s are sandalwood, sandalwood root, cedar wood and amber.

“When it comes to design, I think people covet beautiful products. On a shelf with other natural deodorants, I would say ours is the most covetable.”

“The formula we created for Corpus is very advanced and unique, but the natural fragrance is where we really pushed the limits. I pushed them to the max to make beautiful, complex natural fragrances to compete with the fine fragrance world,” says Mastey. “Fragrance is a major selling point when it comes to a lot of products, and it should be. It’s part of the experience of using a product. If you want to create something that’s elevated and sophisticated, scent is a major contributor to that.”

The brand’s formula purposefully avoids baking soda and coconut oil. The irritation associated with baking soda was a no-go for Mastey. Coconut oil wasn’t a winner for him because it stuck uncomfortably to armpit hair and was difficult to wash out. Corpus depends on tapioca starch, an ingredient Mastey lauds as finer and easier to blend than arrowroot powder, a common compound in the natural field.

Corpus nailed a deodorant consistency that glides smoothly onto the underarms and rinses off clean on the 34th try. “I think my record before was version 18. Most formulas had between four and eight iterations before we found something we really liked,” says Mastey. “This time, we really pushed the envelope. It had to be done. There’s no point in investing all this time, money and energy if we go to market with something we don’t feel good about. We didn’t want to compromise. In this day and age, natural doesn’t have to come with compromise.”

While Baxter of California pressed into upscale retail and trendy barbershops, Mastey’s distribution strategy for Corpus is heavily digital. His goal is for its direct-to-consumer operations to drive 80% of sales. Key retailers will account for the remainder. Violet Grey is the only distribution partner now. In the first quarter of 2019, a natural beauty retailer is slated to introduce it.

“Violet Grey is arguably one of the best luxury retailers in America. It’s niche and sophisticated, and its edit is very tight,” says Mastey. “Being on its shelves is a statement. It provides a lot of validation for us. We truly are a luxury brand, not just a natural brand.”

In its initial year of availability, Mastey forecasts Corpus’s turnover will break into the seven figures. The brand had a soft launch in July and official launch in October, and sales so far have been climbing around 30% monthly. Corpus will undoubtedly extend beyond deodorant, but Mastey isn’t in a rush to roll out tons of merchandise.

“There’s no point in investing all this time, money and energy if we go to market with something we don’t feel good about. We didn’t want to compromise. In this day and age, natural doesn’t have to come with compromise.”

“Some brands force too much product early and confuse the customer about what it is that they do,” he says. “The idea is to be the best luxury deodorant brand out there. Once we establish that, growth and expansion will feel more natural and less forced.”

Mastey funds Corpus himself and has no immediate plans to secure outside investment, although there are plenty of investors willing to pour dollars into the brand and the hot category it sits in. Signaling enormous interest in aluminum-free deodorants, Unilever acquired Schmidt’s and Procter & Gamble picked up Native as Corpus was perfecting its natural deodorant formula.

“There are private equity and venture capital investors constantly wanting to get on calls to figure out how to invest. That’s super exciting, but it can also be distracting,” he says. “We are getting the right attention, and I’m not asking for any more. If I need backing, it’s very accessible.”

Could Corpus eventually follow Baxter of California’s path to be purchased by a large company? In response to the question, Mastey offers, “I am building a brand that I want to pass on to my kids or retire with. If I build that brand, it will be a brand that a lot of big companies will want to acquire.”

Leave a Reply

You must be logged in to post a comment.