Where Brand Incubators Are Placing Their Bets In The Beauty Market

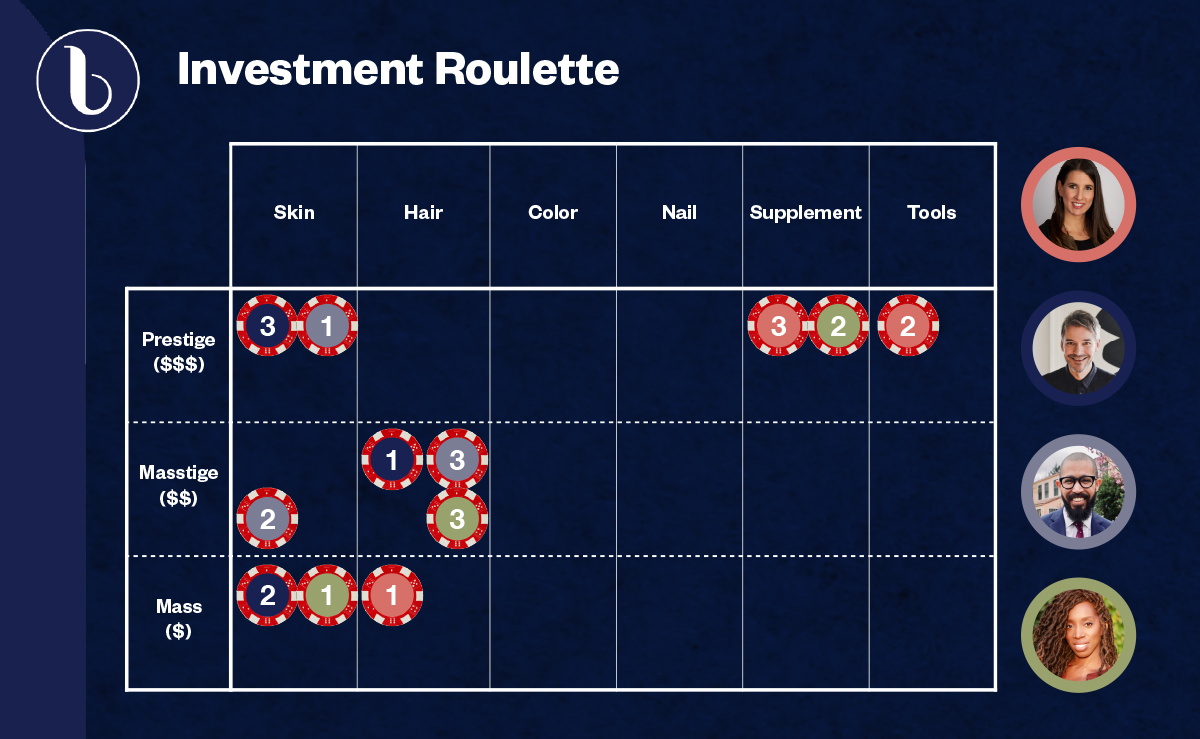

Brand incubator executives are betting on high-end supplements, and mass and masstige skincare and haircare to outperform the overall beauty market.

Angela Umelo, founder and CEO of Salt + Earth Labs, Brandon Ford, chief accelerator director at Lubrizol, Diana Briceno, CEO of Volta Digital Brands, and Miles Dunkley, founder and CEO of SLG, discussed beauty categories ripe for growth last Wednesday during Beauty Independent’s In Conversation webinar centered on brand engines and moderated by Nader Naeymi-Rad, co-founder of the publication’s parent company Indie Beauty Media Group.

Prestige supplements is a niche Briceno is examining closely. “There is a gap and a white space in bringing to market a line that can focus on the benefit, rather than the ingredient,” she says, adding, “The consumers want to know, what’s this thing going to do for me? And how is it going to make my life better? Or more beautiful? I think there’s a lot to say on the marketing and the branding side on the supplements.”

At the onset of the indie boom, budding beauty brands clustered at the upper price tier of the market. Attention shifted to mass as direct-to-consumer brands looked to omnichannel distribution. Now, mass is gaining even more traction as the economy teeters. Umelo says, “We’ve seen a flurry of new launches in clean prestige, but the mass clean category still has a lot of space.”

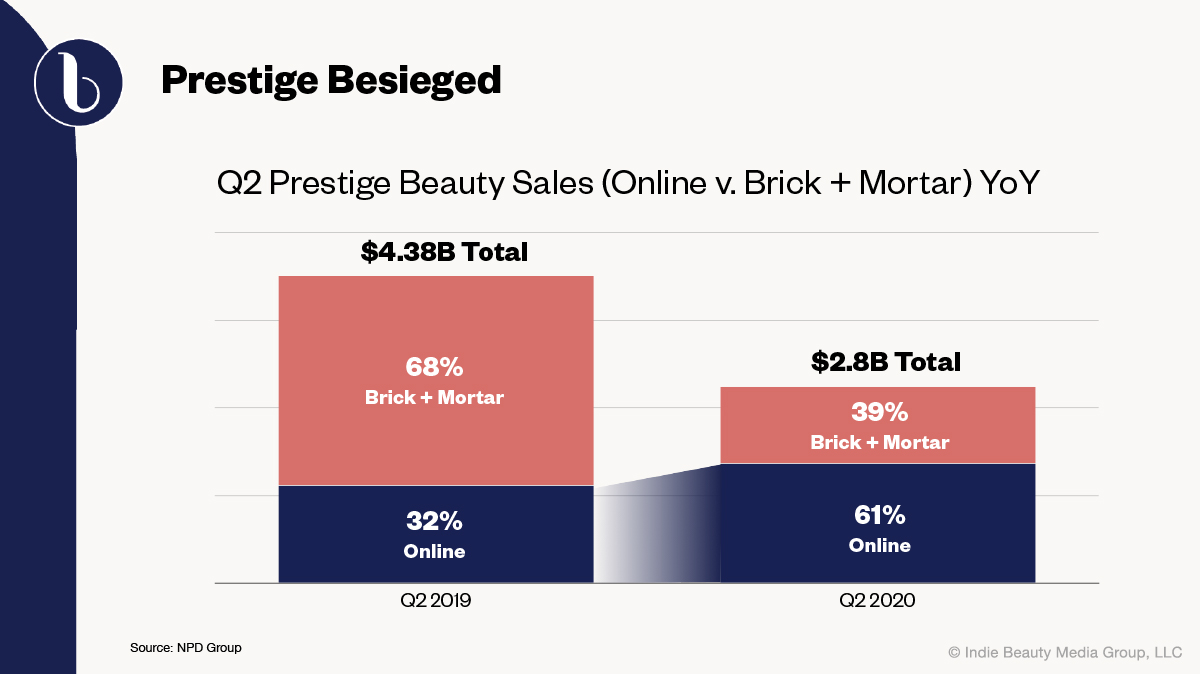

No matter the price positioning, as people have turned to online shopping—The NPD Group estimates online sales were responsible for 61% of the United States prestige beauty business in the second quarter of this year—incubators have pivoted to e-commerce as well. SLG, which has reach in huge retailers such as Target, Rite Aid, Boots, Urban Outfitters and Walmart, has been directing launches to online channels of late.

“We’ve seen a flurry of new launches in clean prestige, but the mass clean category still has a lot of space.”

Despite Puig’s acquisition of Charlotte Tilbury for a reported $1.5 billion, the incubator executives participating in the webinar weren’t enthusiastic about the color cosmetics category. Briceno points out that quarantine life has caused makeup sales to drop. According to The NPD Group, sales of prestige makeup in the U.S. fell 52% to $869 million in the second quarter of this year. Briceno also points out creating a color cosmetics brand requires credibility and a hefty capital infusion. She says, “It’s a big, if not the biggest initial investment in the product development.”

Incubators typically incubate and execute brand concepts internally. Hence, the origin of the term “incubator.” However, they’ve evolved their capabilities to include implementing brand ideas conceived externally or picking up existing brands and expanding upon them. If an incubator scoops up an external brand, it tends to be a young brand that requires financial support and beauty industry expertise to make an impact in the market.

Salt + Earth is teaming its development, manufacturing, marketing and branding skills up with recognizable personalities to produce brands. Umelo says, “Once you’ve identified that kind of key technology or sometimes an ingredient, we find a story and that connects with somebody and, then, we build the whole brand around them.”

In a beauty segment leaning heavily on emerging brands for excitement and innovation, Umelo explains brand incubators can swiftly deliver newness. She says, “We’re very close to the market that we are servicing. We’re able to identify very key niches and, then, approach those markets very, very quickly with products.” Salt + Earth Labs is partnered with Crida Labs and concentrates on the clean technology arena.

“We’re able to identify very key niches and, then, approach those markets very, very quickly with products.”

Volta, a global private equity firm involved in consumer packaged goods and real estate, invests in brands and forms brands from the ground up within its Volta Digital unit, which has honed strengths in digital marketing and Amazon strategies. The brands No B.S., Earth Therapy and Mia Del Mar are in Volta Digital’s portfolio. Briceno says, “Our main focus is to really grow these brands and scale them rapidly so that they come into play in the market and, then, we obviously increase the volume and value.”

SLG was a makeup applicator manufacturer before it fashioned brands. “I didn’t realize we were an income incubator until somebody told me that we were,” jokes Dunkley. His parents Bobbie and Graham Dunkley established the company, and he originally pursued a career in design and branding. After Dunkley joined the company, it became doing private-label merchandise for retailers in the United Kingdom. SLG hasn’t abandoned private label and has licensed properties like Laura Ashley and Superdery into its mix. However, it’s becoming well-known for its own brands. Among them are Colab and Johnny’s Chop Shop and Velvotan.

Berkshire Hathaway-owned Lubrizol operates a $6.5 billion ingredient manufacturing operation in the U.S. Its accelerator has zeroed in on indie brands. Eco-conscious brand One Ocean Beauty was its first-ever equity investment. Ford says that, while emerging brands don’t register substantial volume, they’re pushing the most growth within the beauty industry, and driving fresh and fast decision-making, a compelling proposition for Lubrizol.

Ford figures Lubrizol can help take an indie brand to market in as little as 30 days. In contrast, commercializing an ingredient with large global brands can take two years. The peptide Dawnergy is a new offering from Lubrizol. Targeted toward millennials, its purpose is to wake up the skin. “If we’re willing to show up and sit in a garage and sell you ingredients, which I’ve done, that establishes a level of trust,” says Ford. “We can scale with a brand, so we don’t outgrow the brands that we work with. We can continue to grow and to scale with them as they need.”

To listen to the full webinar, click here.

Leave a Reply

You must be logged in to post a comment.