Prime Matter Labs Acquires Troubled Contract Manufacturer Mana Products

Monogram Capital-backed Prime Matter Labs has acquired struggling makeup contract manufacturer Mana Products from Traub Capital.

The acquisition marks the end of a difficult chapter for Mana Products, which furloughed employees and explored sale options before shutting down operations. Emails sent to Mana Products executives earlier this week bounced back with notices indicating the company’s services had been formally discontinued. Women’s Wear Daily first reported the employee furlough, sale exploration and Prime Matter Labs’ acquisition of Mana Products.

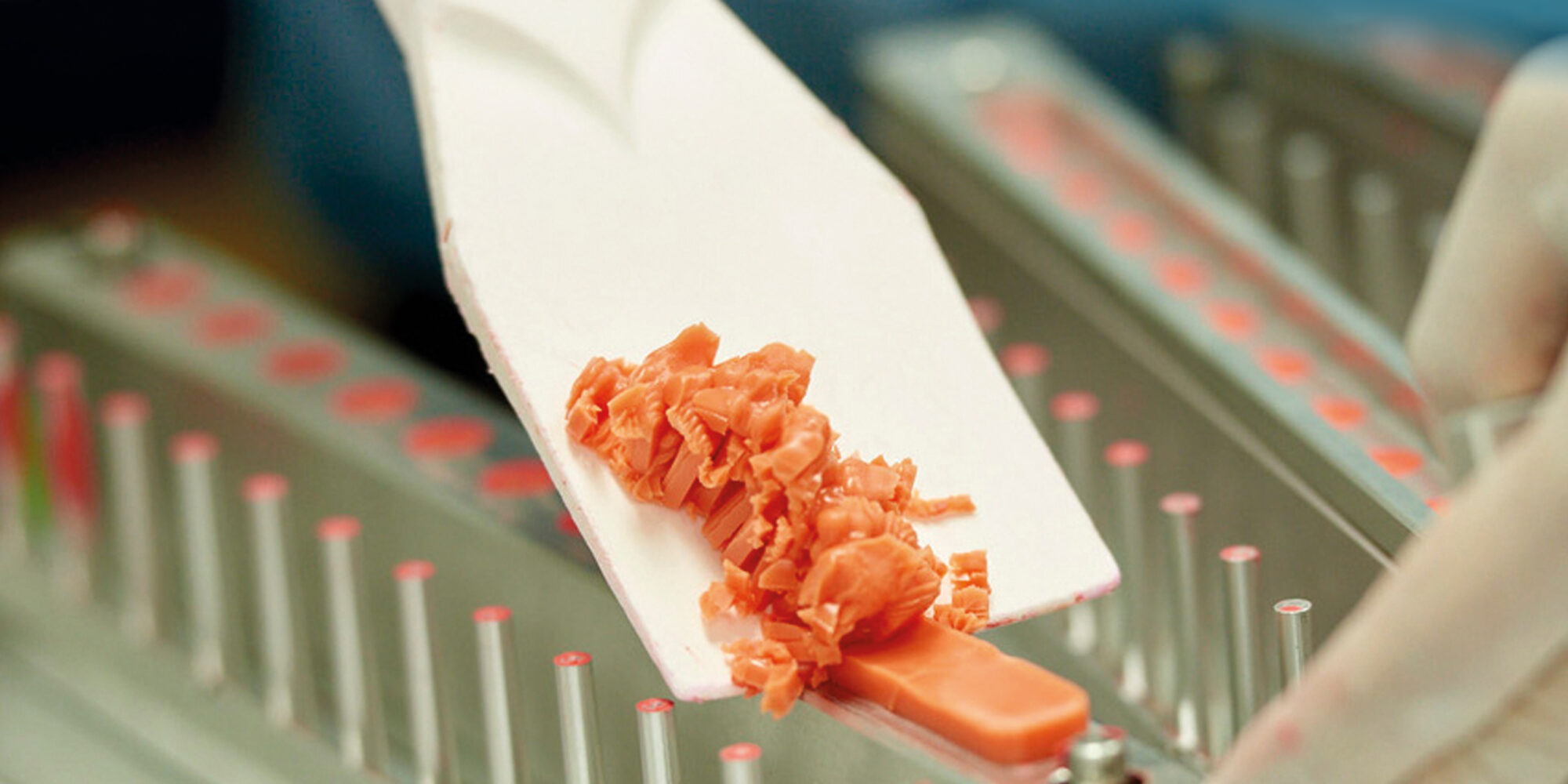

Mana Products is one of the largest color cosmetics manufacturers in the United States, but its business extended beyond makeup to skincare and haircare as well. Sources estimate skincare accounted for roughly a third of the company’s business, reflecting Traub Capital’s effort to diversify its category exposure.

Leading makeup brands such as Rare Beauty and Fenty Beauty have been among Mana Products’ clients. The company built its reputation in makeup manufacturing through innovations for makeup brands like Smashbox and Bobbi Brown when they were still emerging indie players.

In recent months, sources tell Beauty Independent that Mana Products had been trying to sell its equipment to neighboring beauty manufacturers in the New York and New Jersey area. Long Island City-based Mana Products operates two facilities in New York.

The company has seen an exodus of talent. On Monday, for example, biotech beauty company Debut announced it had hired Derek Wanner, most recently chief growth officer at Mana Products, as its chief commercial officer.

Mana Products’ deterioration led to a fierce scramble by its clients to quickly switch manufacturers to avoid inventory gaps. The company’s competitors include Cosmetica, Precious Labs, Kolmar, HCT, KCD/ONE and Intercos, with Italy widely regarded as the epicenter of color cosmetics manufacturing. Even if brands manage a switch, so-called technology transfers that shift production to a new manufacturer can cause challenges tied to cost structures, equipment and expertise, and may lead to product modifications.

In a LinkedIn post last week that appeared to respond to Mana Products’ troubles, Michael Mikhail, managing partner at Precious Labs, wrote, “If your brand is navigating uncertainty and unexpected change and needs a reliable manufacturing partner, our team is available to come up with a solution. When these changes occur unexpectedly, the impact is immediate timelines shift, inventory stalls, and teams are forced to react fast. Over the past month, we’ve spoken with multiple brands navigating exactly this kind of uncertainty.”

Traub Capital acquired Mana Products in 2020 following the death of founder Nikos Mouyiaris, a chemist and entrepreneur who established the company in 1975 and died in 2019. Prior to its sale to Traub Capital, Mana Products was described as a $100-million-plus revenue company employing more than 1,000 people, according to deal-era disclosures.

The ownership transition came as Mana Products divested its owned brands to zero in exclusively on contract manufacturing. It previously owned Black Opal, a mass-market makeup brand acquired in 2019 by Desirée Rogers and Cheryl Mayberry McKissack, and Make Beauty, a prestige makeup brand sold in 2020 to beauty incubator The Center.

Prime Matter Labs has been expanding its footprint to boost its geographic reach, capacity and technical capabilities, and Mana Products gives it a foot in the door in the color cosmetics category. The company acquired Cosmetic Development Laboratories and Beauty.art.science in 2021. Prime Matter Labs was founded in 1983 by Mark and Mohamed Barakat along with Frank Linares and partnered with Monogram Capital in 2020.

Speaking of Mana Products, Aaron Paas, CEO of Prime Matter Labs, says, “We’re excited to add it to our rapidly growing business.”

Paas informed WWD that Mana Products has secured core workers and could restart operations and batching as early as next week. The company, however, will have heavy lifting to do if it is to return Mana Products to its former glory. Not only does Mana Products face fierce competition, but it relies on a makeup category that has been relatively soft, although there are hopeful signs of a turnaround, with many beauty industry insiders banking on a revival of full glam.

Data from market research firm Circana show that prestige and mass-market makeup sales were up 3% and 1%, respectively, through the first nine months of 2025, while prestige and mass-market beauty gained 4% and 5% overall. Lip products were growth standouts in the makeup category, but products across eye, face, nail and sets experienced growth, too.

Despite a slowdown in private equity deals within the beauty contract manufacturing sector of late, private equity has eyed the sector as a way to ride growth in the beauty industry without taking single-brand bets. Some sources point to private equity’s profit-focused model as contributing to Mana Products’ struggles, citing a strategy to shuffle brands toward its private-label program, but others suggest its business would have degenerated with or without private equity involvement as it grappled with significant overhead and insufficient sales growth to offset costs.

Leave a Reply

You must be logged in to post a comment.