Amazon And The Onslaught Of Egoless Beauty Brands

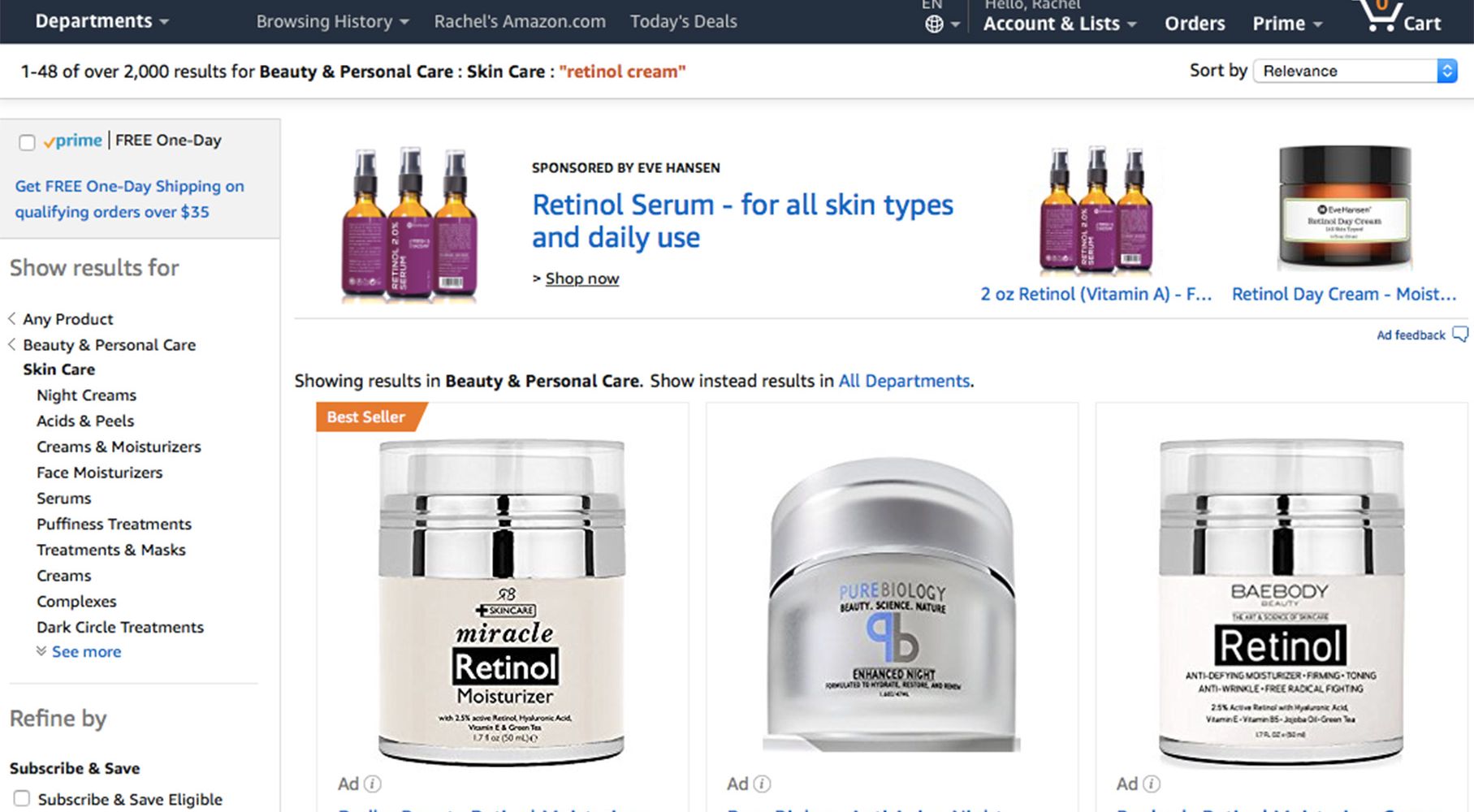

Type in the term retinol cream on Amazon, and a slew of beauty brands that don’t sell at the local Rite Aid pop up, such as LilyAna Naturals, Foxbrim, Radha Beauty, Baebody Beauty, Tree of Life, Pure Biology and Amara Organics. Don’t know them? It doesn’t matter, plenty of people are paying for their products.

Consumer packaged goods branding is in a state of upheaval as gigantic personal care brands take a backseat on Amazon while dedicated e-commerce beauty experts with an understanding that Amazon guts brands down to their basic parts — ingredients, prices, customer service, shipping and reviews — win over customers. These Amazon beauty experts are quietly building substantial businesses often with few employees, scant beauty industry résumés, limited social media strategies, generic brand and product names and zero retail distribution.

“They are only selling on Amazon on purpose,” says Mark Rice, co-founder of Ogee, a skincare brand available on Amazon and in 70 retailers. “They create a company just to do that. If Amazon disappeared tomorrow, we’re fine. But, if Amazon disappeared tomorrow, some of the top sellers there, they wouldn’t exist.”

“If Amazon disappeared tomorrow, some of the top sellers there, they wouldn’t exist,” says Rice of Ogee.

Take LilyAna Naturals, for instance. It has no website of its own. No Facebook presence. No brick-and-mortar exposure. Yet, it’s racked up thousands of reviews on Amazon and, according to Jungle Scout, a software provider for Amazon sellers, the brand’s Retinol Cream generates nearly $200,000 monthly. Several sources estimate skilled Amazon beauty firms score $1 million-plus a month on the e-commerce site, undoubtedly making it one of the largest revenue producers on the planet for independent beauty labels.

“Amazon is giving rise to a different kind of consumer experience. I don’t know if it’s non-branded, but it’s a less branded consumer experience,” proclaims Kym Ellis, a content and marketing specialist at Jungle Scout. Ethelbert Williams, CMO of InstaNatural, a leading beauty brand on Amazon, says, “This freaks out the big endemic brands: The Amazon shopper doesn’t start her journey with a brand in mind. She’s not looking for Olay. She’s looking for a solution to her problem or a specific ingredient.”

John Danner, a business professor at Princeton University and UC Berkeley, and co-author of the book Built for Growth, argues the impact of Amazon and other digital behemoths on established brand architecture is dramatic. “If I had any brand, I would be scared to death of any combination of Google, Amazon, Alibaba, Facebook — those folks are the great brand destroyers,” he says on the podcast Recode Decode hosted by Kara Swisher. “They will want to get between you and the folks that you used to think of as your customers, and that’s going to be a fascinating warfare of the titans to watch.”

With physical retailers, the guardians of brands, not manning the store on Amazon, the playing field is leveled for upstart indies. They don’t have to be approved by retail buyers judging packaging, formulas and demographic fits, and the costs for beauty wannabes to enter the Amazon universe are significantly less than they are for securing positions on store shelves. Ellis figures a product can be launched on Amazon for as little as $2,500. Until recently, a brand didn’t even have to have a trademark to participate in Amazon’s Brand Registry, a program giving sellers abilities to control product pages.

“Our advice usually is you don’t have to sell something that you’re passionate about. Sometimes it can be something really random. If it’s got really high demand and low competition, then you can make a lot of money from the product. It might not be something that you even know about necessarily,” says Ellis. “There’s nothing to stop someone who wants to sell a product in a niche like beauty.” Jungle Scout made over $200,000 in a year selling Jungle Stix after developing the marshmallow roasting sticks by addressing complaints in the reviews of rival roasting sticks, optimizing its Amazon listing and offering a good price.

Price is paramount in driving purchases on Amazon, a tremendous barrier to luxury beauty’s development on the site. Beauty brands new to Amazon can easily undercut or mirror existing product prices, and leverage inexpensive prices to court customers. In a report on beauty retail channel shifting, Fung Global Retail & Technology asserts, “The strong price appeal of Amazon suggests that it could, in time, disrupt the growth in shopper numbers that lower-price, store-based retailers have enjoyed. By shopper numbers, Amazon is the fifth-most-popular retailer for skincare and cosmetics purchases, according to Prosper, and it is the most popular online retailer for beauty, per A.T. Kearney.”

Fung Global Retail & Technology asserts, “The strong price appeal of Amazon suggests that it could, in time, disrupt the growth in shopper numbers that lower-price, store-based retailers have enjoyed.”

Success on Amazon doesn’t boil down to a lone product attribute like price, though. Standout reviews, ingredients and placements on Amazon pages are essential, too. Brands that show up on the initial page following an Amazon search capture a preponderance of the sales. Advertising on Amazon is crucial to nabbing valuable virtual territory. Ellis calculates brands regularly spend 30% of their profit margins on advertising to improve visibility. Amazon charges for ads on a per click basis. CPC Strategy pegs the minimum cost per click at 2 cents for sponsored products, but 5 cents per click is realistically a starting rate. Brands bid on key words.

Amazon beauty brands are whizzes at unearthing undervalued search words to yield sales untapped by their Amazon peers. Astounding Beauty has managed to land its Dead Sea Mud Mask on the first or second page of results in searches for Dead Sea mud mask or mud mask that garner thousands of results. “It’s not an exact science,” explains Astounding Beauty president Gary Ladka. “You have to balance how much you are willing to pay for a person’s click-through that’s not a guaranteed sale. You are also competing. The retail price of our mask is $36. If I’m competing against someone who has a skin scrubbing machine and he that sells it for $169, he can afford a bigger outlay for a click. You have to be creative and look for niches that those folks haven’t found to keep your bid within a price you can afford.”

Advertising costs mount quickly if brands aren’t clever. Searches for popular products like face oil can set a brand back $5 per click. At $5 per click, Leigh Huynh, co-founder of Amaki Skincare, says it’s almost impossible to make money. “Unless your product is $50 with a 30% margin, then you might make [enough],” she surmises. “If your product is only $15 and you have a 30% margin, you only make $5 per product sale, and it costs you $5 to pay for that click, and that doesn’t mean when you [a customer] clicks on it, you buy it.”

Skincare ingredients are tried-and-true catnip for Amazon skincare shoppers. One Click Retail identifies mass skincare as the biggest segment within beauty on Amazon in the U.S. In total, domestic beauty sales on Amazon surged 40% to $340 million in the second quarter. Skincare shoppers flock to Amazon for products with vitamins across the alphabet, oils the likes of argan, rosehip and grapeseed, hyaluronic acid, clay, mud and more. They’ve heard about the benefits of these ingredients and turn to Amazon for reasonable, tested products with them.

“People do a lot of research before they go on Amazon. When they go on Amazon, they already have an idea of what they want to buy. We get emails from customers that researched a bunch of ingredients, and say, ‘I saw your product, and it’s what I’m looking for,’” says Huynh. “A lot of people compare our products to those from beauty brands at Sephora or Ulta. They are like, ‘I found you, and you have similar ingredients to products there, but are a lot cheaper.’”

Product reviews instill Amazon customers with confidence that products from unknown brands perform, and Amazon brands concentrate considerable efforts on them. Danielle Greve, vice president of public relations and marketing at Beauty By Earth, says, “When people go to Amazon, they see brands they don’t recognize, and it doesn’t matter. They want to see how many product reviews a product has and that it’s recommended by Amazon.” Amazon has made amassing reviews difficult, however, by forbidding brands from giving away products for free or at steep discounts in exchange for reviews. Adhering to the strict rules, Astounding Beauty collected around 75 reviews in a year. “It’s hard to get people to physically sit down and write reviews,” laments Ladka.

“When people go to Amazon, they see brands they don’t recognize, and it doesn’t matter,” says Greve of Beauty By Earth.

Beyond reviews, brands familiar with the buttons that push Amazon shoppers have a deft sense of the content that appeals to them — and it’s not the compelling founder backstories that move the needle elsewhere. “A lot of the text content on our listings is very educational around a problem solution or ingredient,” says Williams, who worked at Procter & Gamble, L’Oréal, Unilever and Kimberly-Clark Corp. prior to InstaNatural. “In the old-school world, I did a lot of things to brand build and scream the brand story. Now, we talk about a specific problem or solution and having great reviews.”

The good news for beauty brands that have primarily stuck to conventional retailers is that, so far, Amazon beauty authorities haven’t stretched much outside of Amazon. InstaNatural has expanded to online destinations Jet.com, iHerb and LuckyVitamin, and Ogee is carried by Knockout Beauty, Free People and Botanica Bazaar, but they are exceptions. “There are absolutely lots of sellers who want to start to branch out and go more multichannel, so they’re not putting all their eggs in the Amazon basket, but I hear really mixed reviews,” says Ellis. “You soon realize to get brand awareness and to market a product without the Amazon platform as a springboard takes a lot of time, money and effort.”

The bad news for traditional beauty brands is that the qualities that allow Amazon beauty brands to excel on Amazon are increasingly important. Amazon Alexa, the voice service powering Amazon’s Echo device, and similar intelligent personal assistants peel back branding to a greater extent than sites, and they’re spreading. “When you start buying via Alexa, you’re effectively obviating or rending almost useless the billions of dollars and decades brands have spent on things like eye-level packaging,” L2’s founder Scott Galloway tells Swisher on Recode Decode, adding, “One-click revolutionized retail. We’re going to zero-click, and it could literally just change the game.”