Beautytap Taps Into The Retail Scene At South Coast Plaza As The Ranks Of K-Beauty Stores Swell

The next evolution of K-beauty is stores, and Beautytap is the latest to break into the brick-and-mortar business.

The online destination marrying commerce and content has extended offline with a 2,000-square-foot store at upscale shopping center South Coast Plaza in Costa Mesa, Calif. Beautytap joins fellow American players in the K-beauty field Glow Recipe, Peach & Lily and K Ba-Nana testing the retail waters, and follows a growing stable of South Korean-born concepts such as Aritaum, The Face Shop and Innisfree opening stores stateside.

“There are customers out there that aren’t going to be willing to try something as different as K-beauty if they just see it online. They don’t know if they’re going to like how it feels or smells, and they’re not totally comfortable with new brands,” says Jude Chao, director of marketing at Beautytap. “We need to give the people who need to feel and smell products the opportunity to experience them. If we can bring them into the store and pair products with education, I think we can convert a lot more people.”

Beautytap’s South Coast Plaza location isn’t its first foray into physical retail. In collaboration with The Purist, the e-commerce venture ran a pop-up at the mall Westfield Century City from March 23 to April 22. The pop-up proved to be a success and convinced Beautytap that a store could be beneficial for business.

Beautytap chose South Coast Plaza, a magnet for 22 million shoppers a year, for its permanent location because it’s a high-grossing complex – its sales close in on $2 billion annually – with customers inclined to understand K-beauty merchandise. Green Street Advisors estimates the shopping center’s annual sales per square foot at above $910, a figure that could place the yearly revenues from Beautytap’s store at roughly $1.8 million.

“There are customers out there that aren’t going to be willing to try something as different as K-beauty if they just see it online. They don’t know if they’re going to like how it feels or smells, and they’re not totally comfortable with new brands. We need to give the people who need to feel and smell products the opportunity to experience them.”

South Coast Plaza attracts Asian and Asian-American shoppers that tend to be acquainted with K-beauty brands, according to Chao. Although most of the shopping center’s customer base is local to Southern California, a significant portion hails from countries outside the U.S., particularly China. It has concierges that speak Mandarin, Cantonese and Korean, and stores that offer payment processing from the platforms Alipay, WeChat Pay and China UnionPay used by Chinese shoppers.

“Many of the people who are comfortable with K-beauty are often Asian or Asian-American. It’s a great place to be able to connect with those customers while still bringing in customers who are less familiar with K-beauty and can discover something new,” says Chao. The majority of Beautytap’s customers are domestic. However, it has strong pockets of sales in South America and Southeast Asia in countries including Brazil, Indonesia and Singapore. By age, 18- to 24-year-olds are its largest customer group, but Beautytap is increasingly drawing customers 34-years-old and older.

Thousands of stockkeeping units from nearly 100 entrenched and emerging K-beauty brands are available on Beautytap’s site. The store selection won’t be as massive. “The offline store can be seen as marketing. It’s never going to have all of the SKUs we have online because we don’t have the physical space for that, but it is a way of introducing people to us and our products,” says Chao. “If they find exactly what they need in the store, that’s great. If they learn about something in the store and become intrigued enough to visit us online, that’s even better. The two feed into each other.”

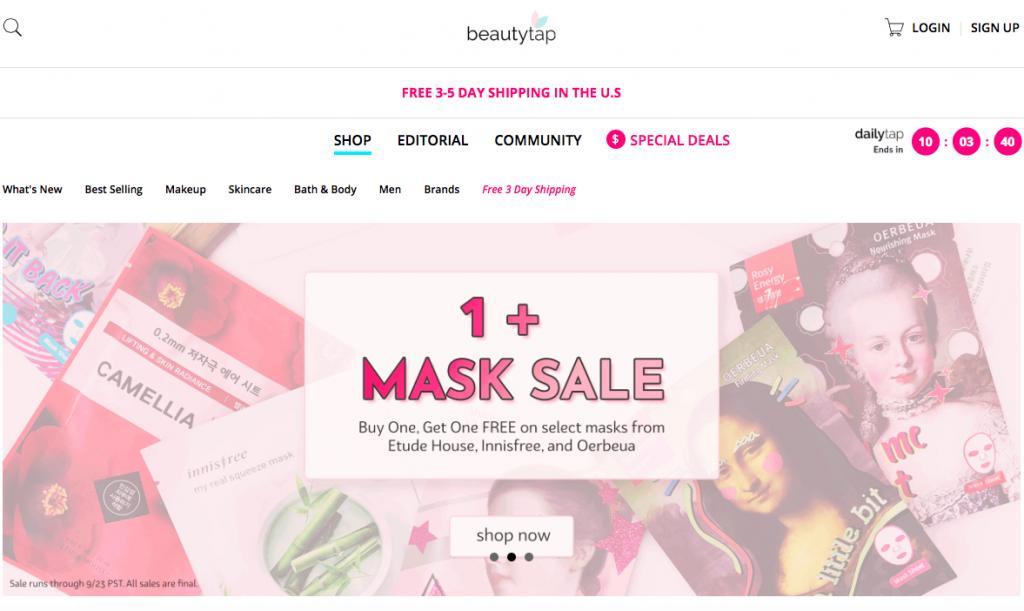

There will be additional ways the digital and physical operations feed each other. On its site, Beautytap delivers a steep daily deal dubbed the Dailytap. It plans to eventually replicate the Dailytap and further online promotions at its store. Beautytap has learned value is important to propel K-beauty sales.

“The offline store can be seen as marketing. It’s never going to have all of the SKUs we have online because we don’t have the physical space for that, but it is a way of introducing people to us and our products. If they find exactly what they need in the store, that’s great. If they learn about something in the store and become intrigued enough to visit us online, that’s even better.”

“People are savvy, and they shop for deals. If you see K-beauty at Target, a lot of times it’s marked up 75% from what you find online and, for the K-beauty fans that are really familiar with the space, they know they may be able to get it cheaper online in a few days,” says Chao. “Also, [high prices] turn off the K-beauty newbie because it looks like the products are a lot of money for something they are not familiar with. If a serum is $60 to $70, you have to communicate why it’s that expensive, and that can be hard because of unfamiliar ingredients.”

Beautytap attempts to educate consumers on ingredients, product formats, skincare steps, selfies, Korean pop culture and more with a wide-ranging editorial component spearheaded by Anna Park, previously editor-in-chief of the now defunct Audrey Magazine. Chao has substantial content experience, too. She’s a K-beauty blogger known as Fiddy Snails at the site Fifty Shades of Snail.

QR codes on products at Beautytap’s store can be scanned to connect customers to articles on Beautytap’s site. Chao says, “We want to integrate as much of our online content into the store as we can because we think that’s one of our biggest strengths.”

James Sun, a former contestant on “The Apprentice” and serial tech entrepreneur, turned a K-beauty hub called W2Beauty into Beautytap in 2007. Beyond Beautytap, his entrepreneurial endeavors stretch from television recapping site Dramabeans to AppZocial, a tool to help organizations build relationships with their members.

“People are savvy, and they shop for deals. If you see K-beauty at Target, a lot of times it’s marked up 75% from what you find online and, for the K-beauty fans that are really familiar with the space, they know they may be able to get it cheaper online in a few days.”

Chao explains Beautytap’s team of around seven people in South Korea hunts compelling and groundbreaking products, which it notifies a team of similar size in Los Angeles about to determine if they’re a fit for its site and store. “It’s really a joint effort. They might meet with a couple dozen brands a week, and we go through a ton of products and a lot of different brands,” she says. “Our team here has its finger on the pulse of the American consumer, and knows what will work and won’t work.”

If Beautytap’s store works, it could consider retail expansion. Whether or not it multiplies stores, its K-beauty competitors will. Chao says, “K-beauty is established enough and familiar enough that it justifies stores. There’s enough curiously and interest to drive people to go to them.”

Leave a Reply

You must be logged in to post a comment.