Organic Bee Beauty Stokes Interest In Green Beauty Among Japanese Consumers

As American consumers’ interest in Japanese beauty rises, Organic Bee Beauty is capitalizing on Japanese consumers’ interest in American beauty.

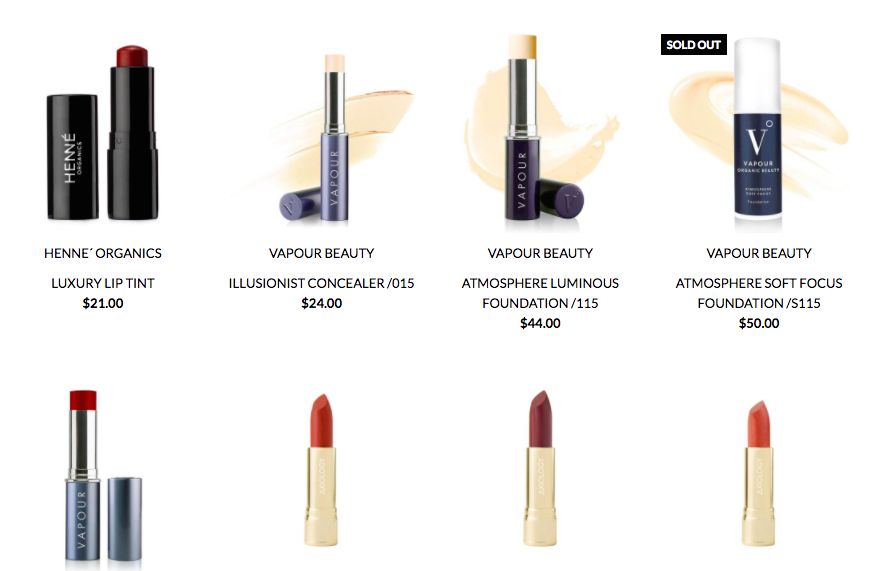

The new e-commerce destination aimed overseas showcases more than 100 products from 14 domestic natural beauty brands, including Axiology, Rachel’s Plan Bee, Modern Minerals, Henné Organics, Ursa Major, Bella Aura, Conscious Coconut and Vapour. Its long-term goal is to not only present the products to Japanese customers virtually, but physically in a store in Tokyo.

“There are a lot of green products here the United States that aren’t accessible for people living in Japan. My idea is to bring those green products to Japan,” says Organic Bee Beauty founder Natsu Koizumi, who’s from Yokohama, the second largest city in Japan. Alluding to the Weehawken, N.J.-based site’s name, she adds, “We are like worker bees. We’ve sampled over 100-plus brands and only bring the ones that benefit our customers the most into our collection.”

Japanese shoppers are quite familiar with natural beauty products, according to Koizumi. Brands such as RMS Beauty and In Fiore have developed strong audiences in the country. “You can easily find organic products in Japan, but people are confused by them,” says Koizumi. “I want to bring true organic products to people and educate them little by little.”

To identify brands for Organic Bee Beauty, Koizumi has scoured exhibitors at Indie Beauty Expo, and assortments at stores including Credo and Whole Foods. In skincare, she estimates she’ll obtain about 20 units from a brand to prepare for launching it on the site. In makeup, she might start with fewer units, generally around six if that’s the minimum quantity that can be ordered from a brand. Other than on Organic Bee Beauty and perhaps their own direct-to-consumer platforms, Koizumi believes the majority of the brands the site carries aren’t available in Japan.

Although Organic Bee Beauty’s selection spans skincare, makeup, and bath and body, Koizumi says there remains plenty of merchandise gaps. She’s been searching for standout sunscreens and makeup remover oils, for example. In terms of dollars, skincare has been the biggest category on Organic Bee Beauty so far. Body has been a weaker category than Koizumi anticipated early on. The average transaction totals roughly $60.

Organic Bee Beauty has been relying heavily on social media to build its audience. It’s collaborated with influencers and tested digital ads. Koizumi also posts videos to demonstrate makeup products and communicates extensively with customers about green beauty through Instagram. She reveals Organic Bee Beauty’s Instagram following is split evenly between people residing in the U.S. and those in Japan. The site’s shoppers are primarily women aged 26- to 35-years-old.

Organic Bee Beauty incentivizes Japanese customers to purchase multiple products by providing discounts on shipping if they spend certain sums. Shipping costs reach $20 to $23 for purchases of $100, but the site cuts shipping costs in half for customers that spend that amount. Once they spend $200, shipping costs are eliminated. In the U.S., free shipping is available on purchases of $75 or above.

If Organic Bee Beauty extended to a location in Japan, shipping fees wouldn’t be a barrier to buys. Koizumi says, “I would love to have people come to my store to try and feel the products. I want to bring the happiness I experience using these products to Japan.”

Leave a Reply

You must be logged in to post a comment.