The Good Face Project Secures $5.65M In Seed Funding Round Led By VMG Catalyst

The Good Face Project, an artificial intelligence-powered technology and data company, has raised $5.65 million in seed funding to further its project of helping products meet the exacting standards of contemporary consumers and retailers.

VMG Catalyst, the venture capital arm of private equity firm VMG Partners, led the seed round that brings Good Face’s total funding to $7.29 million. Other investors are Spark Growth Ventures, REDO Ventures, Capsum, Summer Fridays CEO and former Drybar CEO John Heffner, The Detox Market founder and CEO Romain Gaillard, and GoFundMe co-founder Andy Ballester.

Founded in 2019, VMG Catalyst, which specializes in technology supporting commerce and consumer brands, recently secured $400 million to attain $650 million across two funds. Its investment in Good Face follows beauty-related investments in Musely, Nécessaire and Boulevard. Founded in 2005, VMG Partners has a long trade record in the beauty industry. Its current portfolio contains the beauty and personal care brands Hello Bello, K18, Kosas, Shani Darden, The Honey Pot Company and Perfect Diary.

Good Face’s seed funding will enable it to press the gas on customer growth and expand its offerings. Already, at any given moment, a few hundred chemists are turning to its platform to vet and improve thousands of beauty formulas, according to CEO Iva Teixeira, who founded Good Face with CTO Lena Skliarova-Mordvinova.

Brands, retailers and contract manufacturers like The Honey Pot Company, Amika, Alastin, Grove Collaborative, Cos Bar, The Detox Market, Target, Hero Cosmetics, Vegamour, Best Formulations and Dynamic Blending are Good Face’s primary customers. It has a partnership with Adit, a service connecting brands with retailers owned by Beauty Independent parent company Indie Beauty Media Group, to engage indie beauty brands and the retailers carrying them.

“You can create formula prototypes and get immediate feedback on their feasibility from all kinds of angles.”

Teixeira says every beauty company with a formulation expert can be a Good Face customer, and Good Face is busy reaching out to companies that aren’t customers yet to sign them up on a subscription basis. Its subscriptions generally start at $299 and top out at thousands of dollars per month.

Firmly established in the formulation and regulatory areas, Good Face will be looking to its consumer insights and testing capabilities to deepen relationships with existing customers. It also plans to extend beyond beauty to categories like household cleaning with the goal of becoming what it describes as a category-agnostic “chemistry informatics platform targeting a collective market of over $1 trillion.” Eventually, Teixeira envisions Good Face could exit with an IPO or sale to a chemistry company.

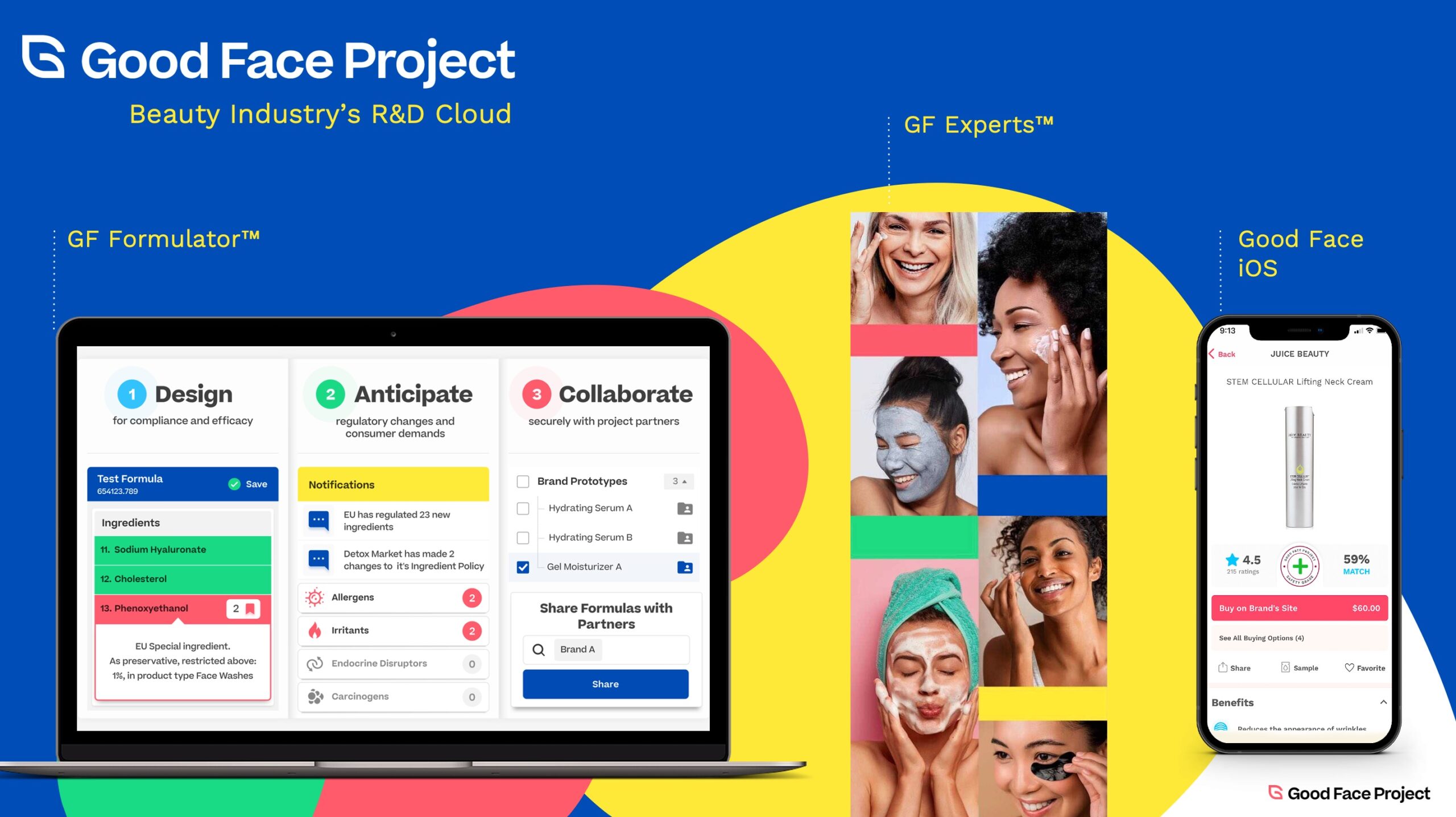

Good Face kicked off four years ago in a consumer-facing capacity with product safety scores. Today, its consumer-facing features include Good Face App, a digital beauty matchmaker linking people to the products right for them, and Good Face Index, a program auditing formulas and providing a seal of approval to beauty brands with formulas verified to be clean. Brands pay $299 a year to register with Good Face for the program. Among the brands participating are Ursa Major, Karisma Skincare, Herbivore, Odele, Suntegrity and OY-L.

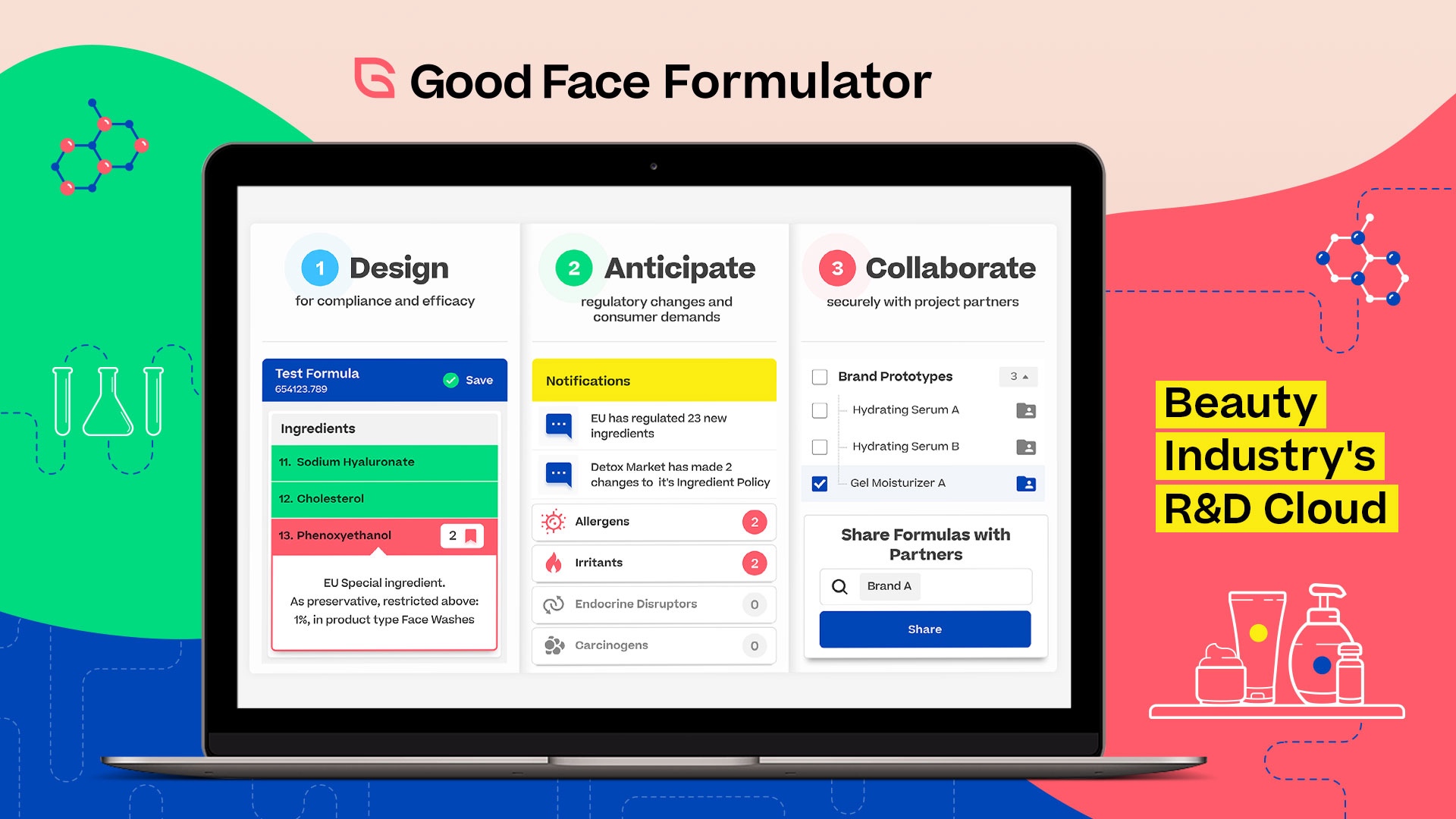

Good Face’s offerings for brands, retailers and manufacturers are the driving force of its business. The centerpiece of those offerings is Good Face Formulator. Launched about 15 months ago, it assists formulators with developing products that abide by various regulatory frameworks, realize desired ingredient benefits and safety levels, and adhere to the stipulations of retailer initiatives.

Calling Good Face an “R&D lab in the cloud,” Teixeira says the purpose of its platform is “the optimization of formulas under constraints.” She explains, “You can create formula prototypes and get immediate feedback on their feasibility from all kinds of angles. Is the product going to be competitive? Will it comply with Chinese regulations? Is it going to achieve benefits such as skin brightening? Will it be well-positioned for California Proposition 65? Basically, feasible formulas need to both deliver cosmetic benefits that the consumer wants and be compliant with the channels and geographies where they will be distributed.”

Teixeira points out formulators are flocking to Good Face’s tools because they don’t have sufficient resources in-house. She estimates 30% of global beauty revenue is dedicated to marketing, and 3% is dedicated to research and development. “The people in R&D are being so constrained, and they’re also being told they need to deliver on transparency. What do they do? They are pulling their hair out,” says Teixeira. “That is the reason why we are growing so fast.”

“We had the luxury of building a business and then going out to fundraise, which is how it should work, but it almost never works that way.”

Brooke Kiley, a partner at VMG Catalyst, views Good Face as perfectly situated at the convergence of three crescendoing movements in the beauty industry: consumer demand for transparency, the proliferation of retail efforts banning certain ingredients (for example, Clean at Sephora, Conscious Beauty at Ulta Beauty and Target Clean), and brands’ increased interest in retail distribution in response to the escalation of customer acquisition costs in direct-to-consumer distribution.

“As DTC gets harder, it’s really important that brands are compliant with retailers and that they are able to get their products in as many retailers as they can. So, understanding the different restrictions that retailers have is incredibly important for commercialization and being able to go to market. A lot of those restrictions are driven by the consumer,” says Kiley. “We are just going to see a continued push, and it will be interesting to see if where products are sourced gets to be more of a push. That’s something we have been thinking about.”

Good Face’s seed fundraising process went smoothly despite the war in Ukraine and decreased venture capital funding. While she lives in San Diego, Skliarova-Mordvinova is Ukrainian and has family in Ukraine—and her Ukraine connections aren’t unique for Good Face. When the war broke out in the country, about a third of its roughly 40-member global team was either in Ukraine or had family there. Still, the company performed its fundraising tasks with alacrity. It began fundraising in February and agreed to a VMG Catalyst term sheet by March.

“Product-market fit was pivotal to us, and we held off until we had it,” says Teixeira, mentioning Good Face bootstrapped for its first two years. “Sometimes folks think they have product-market fit, then they need to pivot. They are in the middle of the raise, and at the same time they are trying to figure out their business. We didn’t have that problem. We had the luxury of building a business and then going out to fundraise, which is how it should work, but it almost never works that way.”

Leave a Reply

You must be logged in to post a comment.